With more than 200,000 active COVID-19 cases across Mexico, the second wave of the pandemic maintains pressure on Latin America’s second-largest economy. Despite ongoing issues and an uncertain outlook, the latest polls show that Mexican President López Obrador added to his approval rating in November to 61%. Amid an absence of bullishness, the USD/MXN remains vulnerable to a new breakdown.

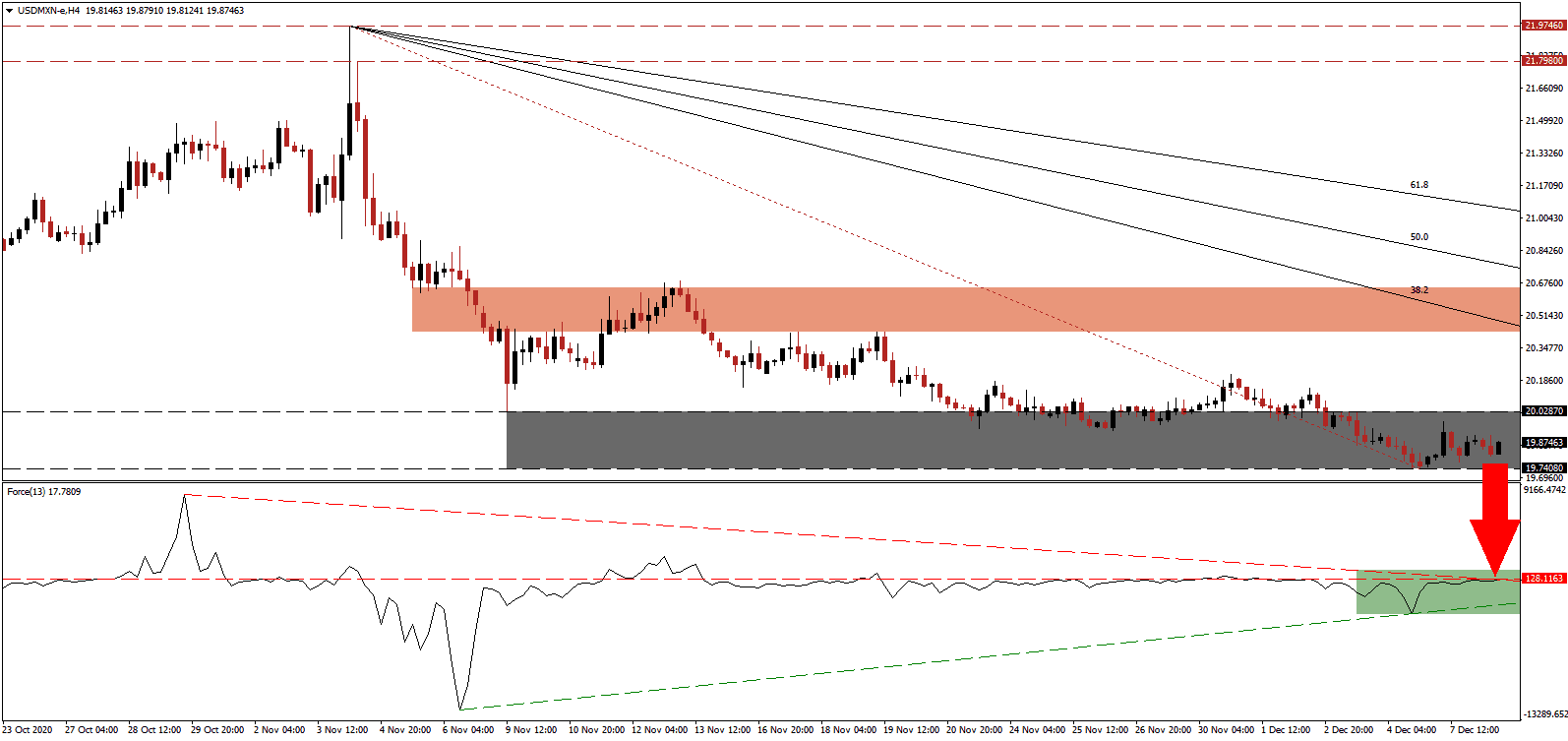

The Force Index, a next-generation technical indicator, flatlined below its horizontal resistance level. Adding to breakdown pressures is the descending resistance level, as marked by the green rectangle, favored to pressure for a correction below its ascending support level. Bears wait for this technical indicator to retreat below the 0 center-line to regain complete control over the USD/MXN.

According to the latest assessment by the Mexican Institute of Finance Executives (IMEF), Mexico faces economic weakness ahead. The IMEF Manufacturing Index clocked in below 50.0 for the eighteenth consecutive month in November. The descending Fibonacci Retracement Fan sequence maintains the bearish chart pattern, and the short-term resistance zone between 20.4297 and 20.6548, as identified by the red rectangle, awaits a downward revision.

Mexican President López Obrador picked Galia Borja as the next Deputy Governor of the Banco de México, replacing potentially the most hawkish member of the central bank. Tatiana Clouthier will become the new Secretary of Economic Affairs. The USD/MXN remains on course to correct through its support zone between 19.7408 and 20.0287, as marked by the red rectangle. The next one awaits between 18.9748 and 19.2602.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 19.8700

Take Profit @ 18.9700

Stop Loss @ 20.1200

Downside Potential: 9,000 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.60

Should the ascending support level guide the Force Index higher, a short-covering rally in the USD/MXN may follow. It will present Forex traders with a secondary selling opportunity amid a deteriorating outlook for the US dollar. The upside potential remains limited to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/MXN Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 20.3700

Take Profit @ 20.7200

Stop Loss @ 20.1200

Upside Potential: 3,500 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 1.40