Despite having the fourth-highest COVID-19 death toll and being the thirteenth most infected country, Mexico opted against restrictions. Public venues remain filled with people, resulting in a warning from the World Health Organization (WHO). Adding to an unclear picture is the low testing rate, one of the lowest globally. Ongoing US dollar weakness allows bearish pressures on the USD/MXN to remain dominant, with a new breakdown pending.

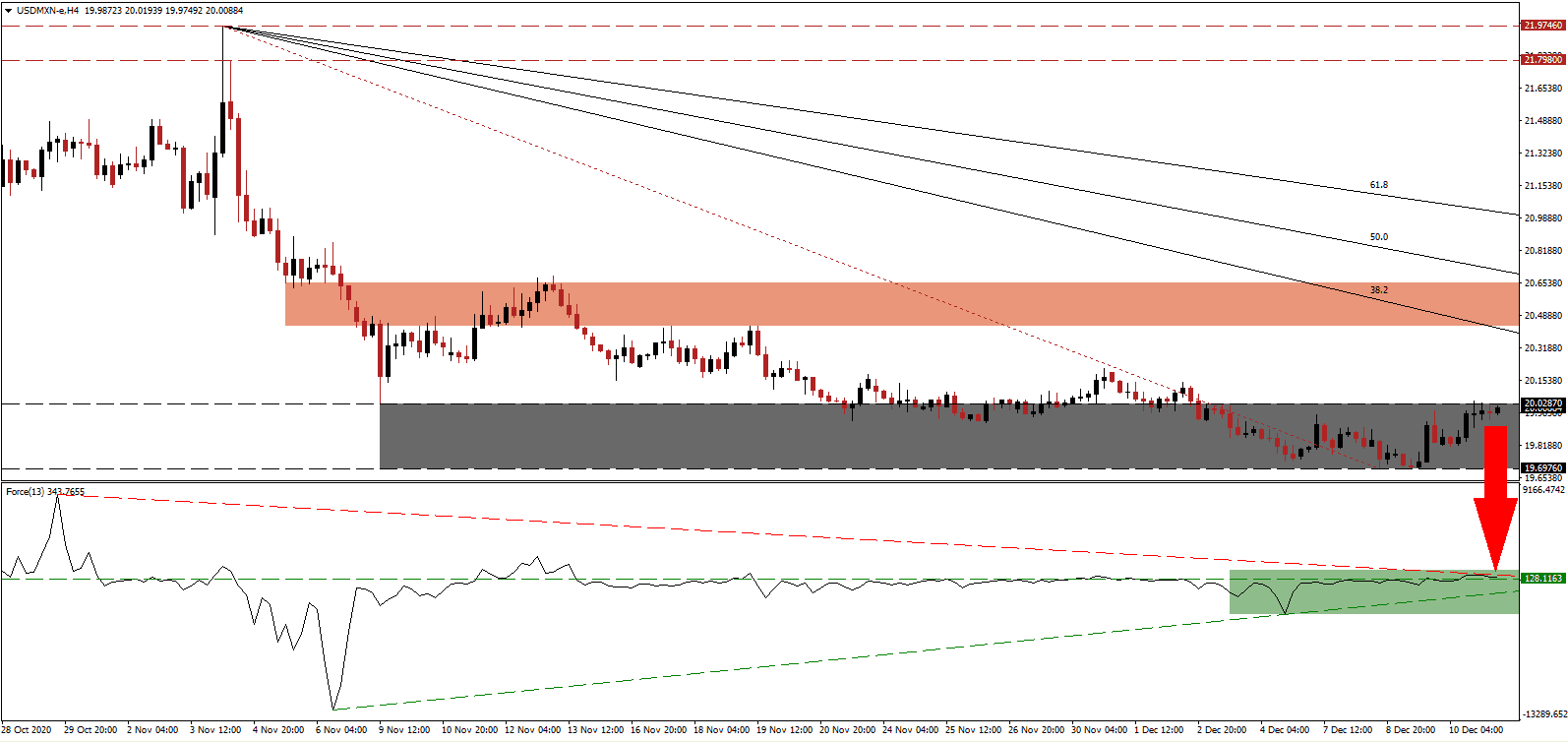

The Force Index, a next-generation technical indicator, was able to convert its horizontal resistance level into support, as marked by the green rectangle, resulting in an adjustment to the descending resistance level. Bullish momentum faded, and a collapse through its ascending support level can follow. Bears wait for this technical indicator to correct below the 0 center-line to regain control over the USD/MXN.

Data from the Instituto Nacional de Estadística y Geografía (INEGI) showed third-quarter GDP expanding by 12.1%, beating expectations. The economy remains 8.6% smaller than one year ago. Mining, energy, and manufacturing led the rebound. The breakdown in the USD/MXN below its short-term resistance zone located between 20.4297 and 20.6548, as identified by the red rectangle, ensured more downside could materialize.

Mexican President López Obrador announced plans for a third consecutive annualized increase in the minimum wage. In US dollar terms, the monthly minimum will increase from $187 to $215, per a slide show presented by the Secretary of Labor Luisa María Alcalde Luján. The descending Fibonacci Retracement Fan sequence is well-positioned to force the USD/MXN through its support zone between 19.7408 and 20.0287, as marked by the red rectangle. Price action will challenge the next one between 18.9748 and 19.2602.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 20.0000

Take Profit @ 19.0000

Stop Loss @ 20.2200

Downside Potential: 10,000 pips

Upside Risk: 2,200 pips

Risk/Reward Ratio: 4.55

Should the ascending support level pressure the Force Index higher, the USD/MXN could follow suit. More localized restrictions in the US and a weakening labor market recovery magnify the bearish outlook for the US Dollar. The upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level, and Forex traders should sell rallies.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 20.4300

Take Profit @ 20.6500

Stop Loss @ 20.2200

Upside Potential: 2,200 pips

Downside Risk: 2,100 pips

Risk/Reward Ratio: 1.05