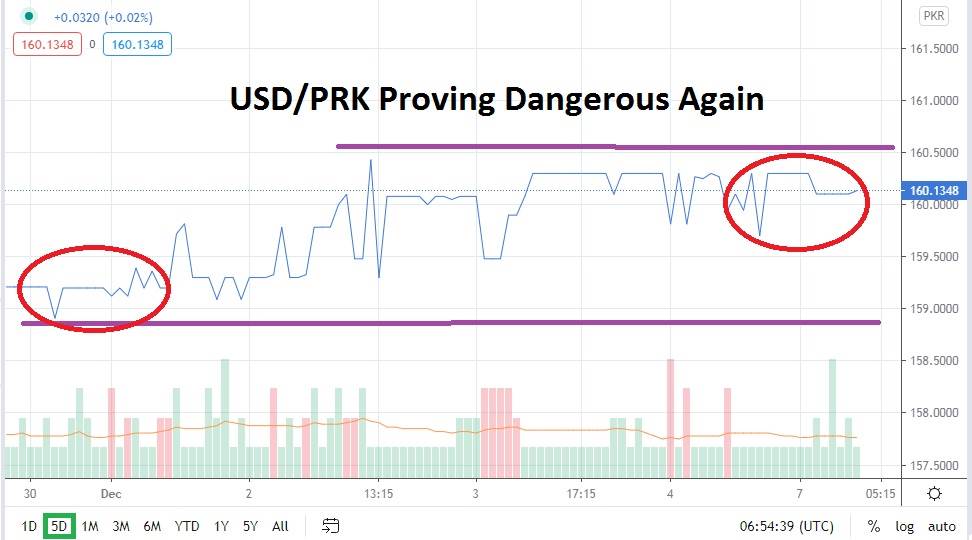

Speculators of the USD/PKR have had their stamina tested if they have continued to pursue selling positions in the short term. As of this morning, the USD/PKR is proving dangerous for traders as it displays the capability to maintain near-term higher values and sustains a price below the important resistance level of 160.300.

If the 160.300 juncture becomes vulnerable, the next resistance level for the USD/PKR may be targeted at 160.750, which did see a handful of tests through the 20th to the 25th of November. In fact, the 161.000 mark was approached on the 24th, but did see a rather quick selling reversal take hold. The question speculators need to answer is if another attempt to retest near-term highs will take place. If a trader believes this is in the proverbial cards via their technical analysis, they may want to consider quick buying positions with take profits placed near the 160.600 level.

The USD/PKR is within a delicate price range and the mid-term trend of the Forex pair has been bearish. However, this is the Pakistani rupee we are discussing, which is certainly not considered among the most transparent currencies financially. The current Pakistan government does find itself within a battle for the hearts of their citizens as opposition political parties in the nation make claims that the economy is being mismanaged.

Risk appetite globally, however, remains rather optimistic, and this may continue to create a foundation for the USD/PKR near term. If the Pakistani rupee can continue to attract support via financial institutions and government transactions through commerce, the Forex pair may have room to resume a bearish trend. Yet, this is speculative and traders really do not have much evidence to examine besides technical charts, and that may be for the best.

Traders should continue to use limit orders with the USD/PKR. If they believe resistance marks which are being flirted with will be tested short term, buying the USD/PKR should be undertaken. However, traders may also want to be on the lookout for reversals near key resistance targets and for another round of bearish momentum. Selling the USD/PKR when it touches resistance and speculating on a downward march may feel dangerous – and it likely is- but it may prove worthwhile for traders with patience.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 160.3000

- Current Support: 159.8800

- High Target: 160.7500

- Low Target: 159.5000