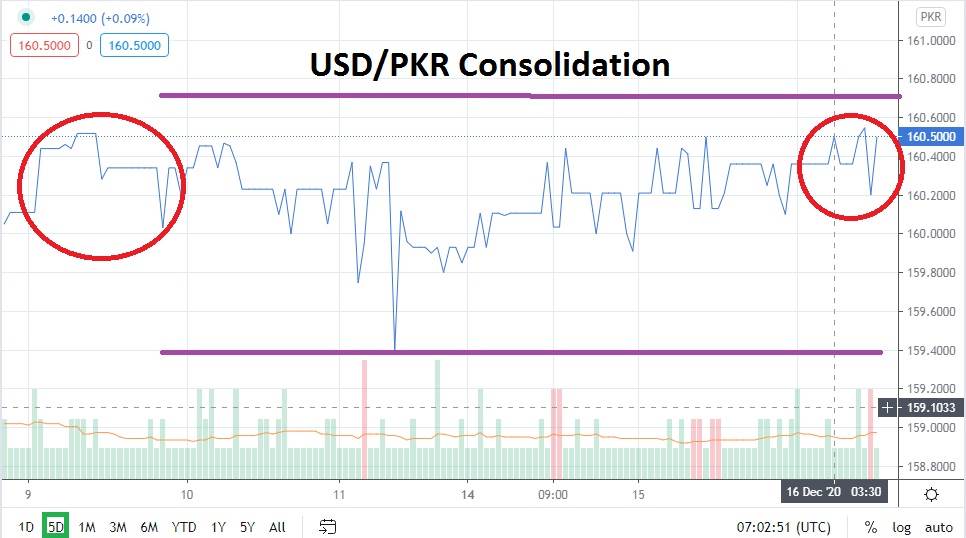

The USD/PKR may be making speculators who have been inclined to pursue its mid-term bearish trend uncomfortable. Support levels have been incrementally rising since the last week of November. Consolidation the past few days is also making decisions difficult. On the 16th of November, the USD/PKR was trading near a low of 157.7000, but since then has reversed higher and seen choppy conditions emerge.

As of this morning, the USD/PKR is trading near the 160.5000 mark, which is close to important resistance. On the 24th of November, the Forex pair approached the 161.0000 mark before reversing lower. On the 28th of November, the USD/PKR was again testing lows and traded near the 158.5000 level.

However, the USD/PKR has also been within a solid bearish mid-term trend which is causing speculators to contemplate the Forex pair’s short-term trend versus longer technical guideposts. The current level of the USD/PKR appears to be a key inflection point and speculators need to be prepared for potential volatile trading to breakout. The question is which direction the Forex pair will take when its consolidation falters.

As resistance, the 161.0000 value appears to be important, but if it is broken higher and the USD/PKR breaks the 161.1000 to 161.2000 junctures, it would be challenging values last seen in late October and potentially indicating a further bullish run higher. However, intriguingly, the bearish trend technically still may be signaling that speculators should contemplate the fact that bearish sentiment will reignite.

The USD/PKR is in a tight range, but if downward price action begins to unfold within the Forex pair and the 160.2000 level is broken, traders should look to see if trading can be sustained beneath this juncture. If support begins to look vulnerable, it is conceivable that the USD/PKR may re-establish its bearish momentum. Skeptical traders may suspect the current price range of the Forex pair has found equilibrium and its recent consolidation is a sign of things to come. If that is the case, pursuing the USD/PKR for short-term reversals is the key.

However, the USD/PKR has a long habit of producing rather strong movements and providing speculators with an opportunity to pursue trends. The current value range is likely to be tested sooner rather than later. Sellers of the USD/PKR will need their stop losses working, but pursuing a short position within the current price vicinity is a logical speculative wager.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 160.7500

- Current Support: 160.2000

- High Target: 161.1000

- Low Target: 159.7500