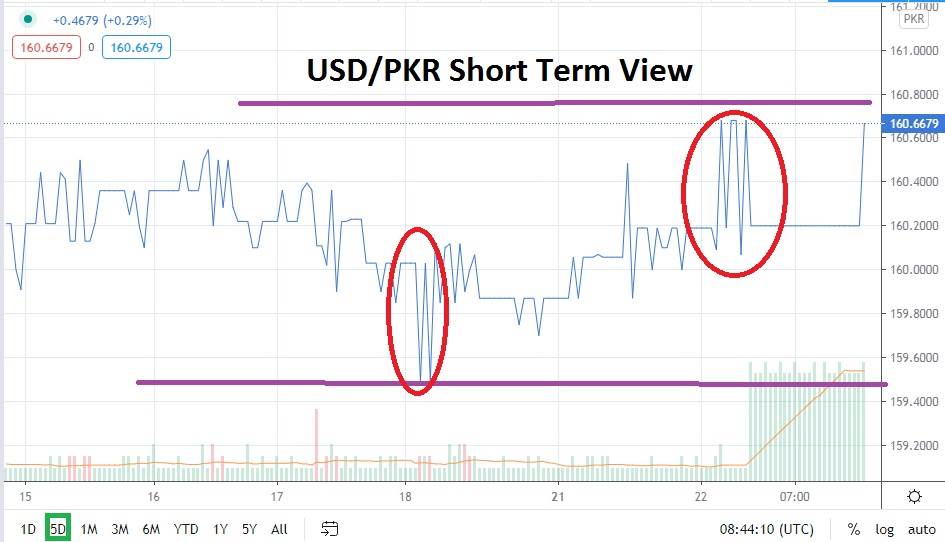

The USD/PKR is near critical resistance levels in early trading today. The 160.700 value is acting like a magnet, but has proven to be an adequate juncture to sell the USD/PKR before. Support levels have also proven durable in the short term and the 160.200 has proven tough to penetrate below. Speculators could put on polite trades using limit orders near current values which are testing resistance, and look for support levels to be targeted again near term.

However, traders may also be intrigued by the notion that prevailing sentiment may be shifting short term, and risk-averse conditions may be rising. If this is the real circumstance, the USD/PKR may prove that it has the ability to break through current resistance and test higher values. If the Pakistani rupee does break the 161.000 juncture and prove it can sustain values above the mark, it will be a clear signal that risk-averse trading has taken hold and potentially strong bullish momentum may mount.

Cynics, though, will be sure to point out that the USD/PKR doesn’t exactly trade in a correlated fashion with many other emerging market currency pairs. The technical timeline of the USD/PKR’s rather solid bearish trend which was displayed from late August until the middle of November has withered. Resistance levels the past month have incrementally risen, but the 160.800 juncture has proven quite adequate since late November and remains the case.

The month of December has produced rather consolidated trading within the USD/PKR, and this week could prove to be rather volatile if the Forex pair produces a breakout. In the meantime, traders may have to practice patience and wait for momentum to grow within the USD/PKR before it demonstrates a move which blasts through resistance or support levels.

At its current high levels, the USD/PKR remains a truly speculative endeavor, and for traders with strong enough stomachs to wager, a selling position may be the most rational decision. Current resistance levels have proven strong the past month and, until they are broken higher, the USD/PKR remains an attractive opportunity to pursue downside momentum with carefully chosen take profit and stop loss ratios. Selling the USD/PKR on slight upward movements and looking for the pair to trend towards current support junctures remains a logical choice.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 160.7500

- Current Support: 160.2000

- High Target: 161.1000

- Low Target: 159.5000