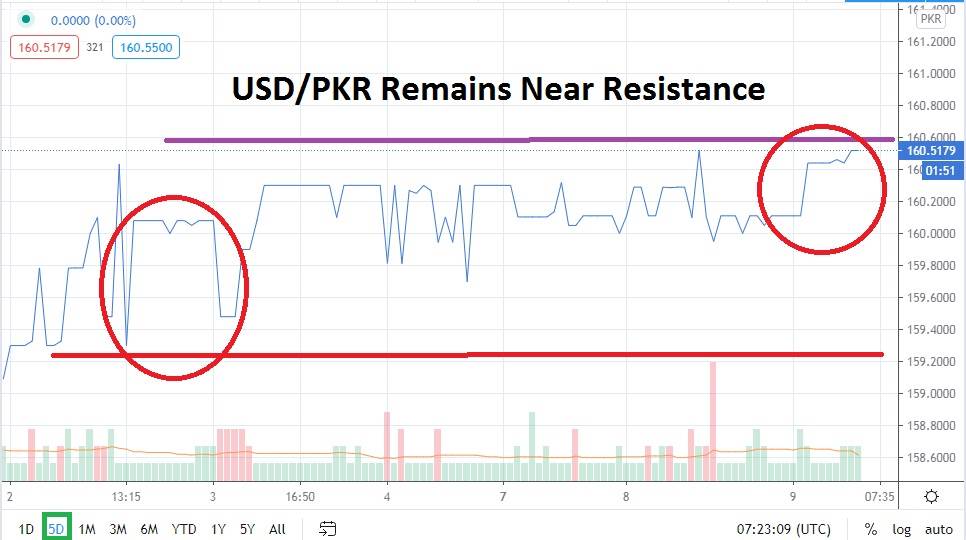

After being able to display a solid bearish trend since late August, the USD/PKR has seen a small bullish reversal take place since the end of November. This shift in the trend may be creating speculative unease among traders as important resistance levels feel as if they are being targeted. On the 23rd of November, the USD/PKR touched an approximate high of 161.0500 before its bearish trend resumed.

Before touching the high on the 23rd of November, the USD/PKR had attained a low of nearly 157.6500 on the 17th of November. However, after touching this low water mark, the USD/PKR has found choppy trading conditions prevail as trade winds seem to be blowing the Forex pair in a rather reversal-filled mode. Shortly after hitting the highs of 161.0500 on the 23rd of November, the USD/PKR did display another leg down and tested the 158.6000 price.

Now that the USD/PKR finds itself beginning to traverse higher values again, the past two weeks since hitting its most recent low on the 27th of November has displayed an incremental rise. Interestingly, the current values the USD/PKR is trading within have been accomplished without violent spikes. Technical charts show a rather tranquil path of short-term highs being reached without exaggerated moves. Speculators need to decide what the lack of volatility means for the USD/PKR now.

Global risk appetite remains steady; many major equity indices continue to maintain higher values. However, traders need to understand that the USD/PKR works outside of many known financial institutional universes and the trading of the Forex pair is not exactly transparent. The incremental gains made by the USD/PKR in a polite manner may mean more upside action will develop short term and resistance levels of 160.7500 to 161.0000 may be tested.

Cautious traders may want to wait for the USD/PKR to hit higher targets with limit orders to sell the Forex pair at the indicated resistance levels. Risk-takers may believe there is an opportunity to capture some upside movement and place buy orders slightly below current market prices and pursue bullish moves. Near term, the USD/PKR may continue to challenge resistance, but traders who are influenced by the mid-term trend may believe another bearish trend will ignite within these higher values which the Forex pair is now traversing.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 160.7500

- Current Support: 160.1000

- High Target: 161.2500

- Low Target: 159.8000