The USD/PKR is not a Forex pair that all speculators pursue. The USD/PKR is an adventure land for experienced traders who understand that price fluctuations can often be violent. While conservative speculators may not like the notion of trading the USD/PKR because it is too volatile, this same characteristic of the Forex pair makes it attractive to wager on particularly if there is a perceived direction.

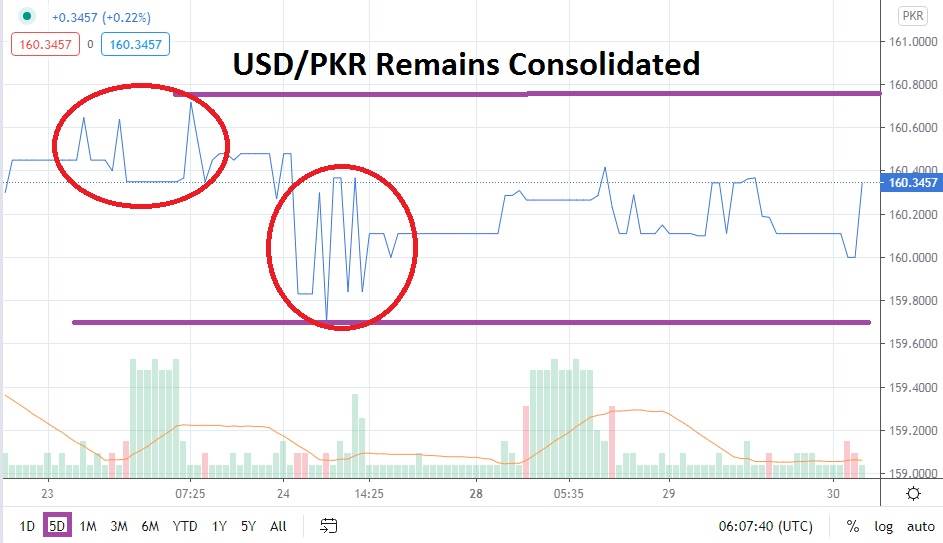

The USD/PKR has been languishing within what can be described as a tight range. The 160.0000 to 16.5000 junctures have dominated trading the past few days. Speculators participating in the Forex pair not only like volatility, but they often like quick trades. Perhaps light holiday trading volumes are causing the lack of movement within the USD/PKR. It is hard to tell sometimes because of the lack of transparency, which is part of this Forex pair’s makeup.

However, intriguingly, the current consolidation within the USD/PKR may prove very attractive for technical traders who prefer the potential of volatility when they believe they can see evidence of a coming move. Yes, the USD/PKR has been rather quiet, but its mid-term bearish trend remains within place, and even though the month of December has produced a slightly higher incremental climb, the USD/PKR remains within its lower boundaries when looking at a three-month chart. The USD/PKR has also shown a tendency this past week to incrementally lower its resistance levels.

No, the trading within the USD/PKR has not been a vast sea of volume, so a cynic can successfully argue that the lower resistance levels may not mean too much as holiday trading rules Forex. However, global risk appetite remains steady to optimistic, and the perception that the USD/PKR remains within a bearish trend correlated to the large Forex markets is intact. The recent tight value range of the Forex pair is not likely to remain steady; the question is when the USD/PKR will see a breakout and which direction it will be in.

Selling the USD/PKR at its current price levels while using limit orders looks like a rather interesting speculative trade. If the USD/PKR does prove the 160.0000 support level is vulnerable, the next target below is 159.7000, and if that mark should falter, the Forex pair could deliver the volatility speculators seek.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 160.5000

- Current Support: 160.0000

- High Target: 160.8000

- Low Target: 159.7000