Singapore continues to lead global efforts to recover from the COVID-19 pandemic. With the virus under control and a disciplined society following the advice of healthcare experts, the World Economic Forum (WEF) considers moving the 2021 event from Davos, Switzerland, to Singapore. A postponement to May 2021, due to COVID-19, preceded discussions. Bearish pressures on the USD/SGD rise inside its support zone, suggesting a pending breakdown.

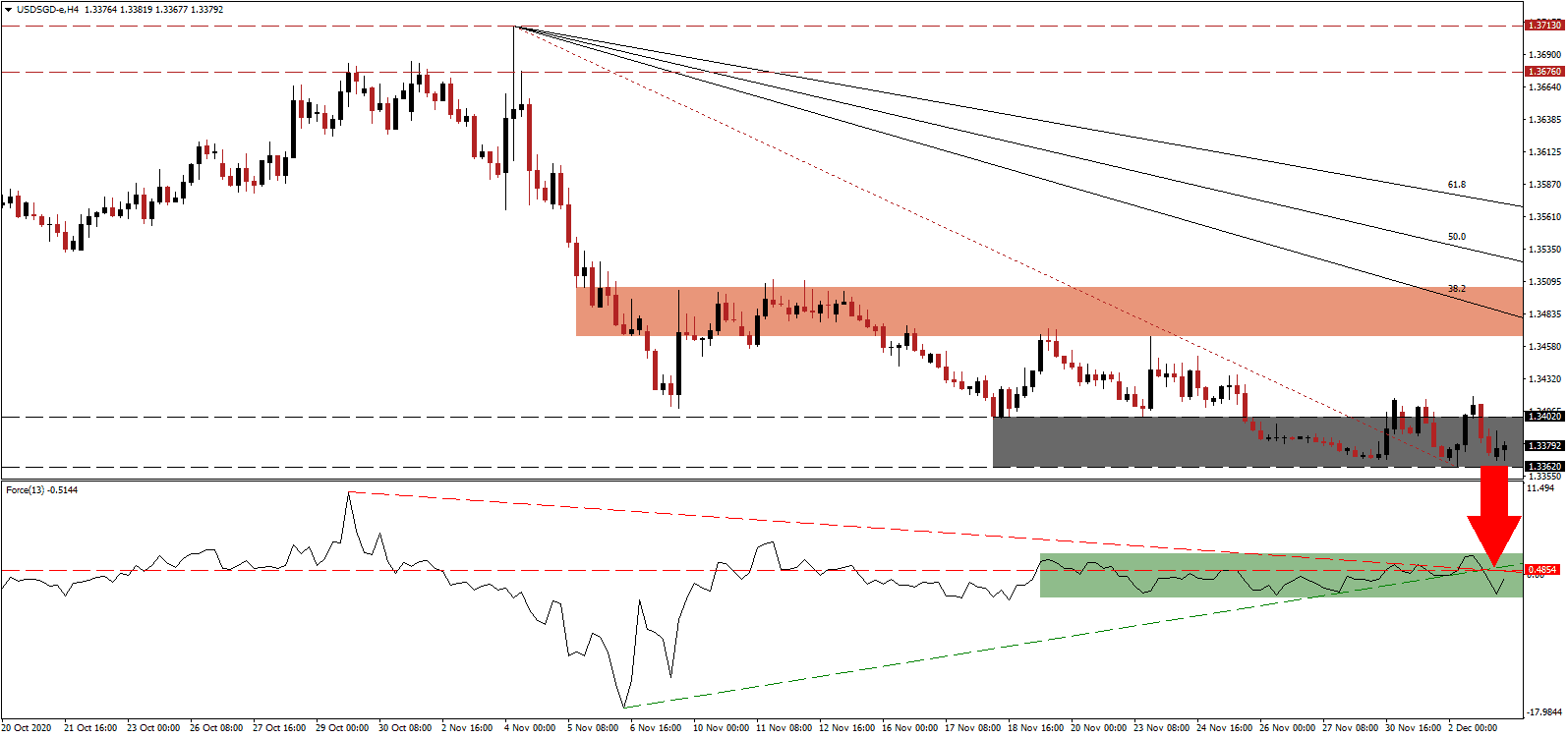

The Force Index, a next-generation technical indicator, is under intensified bearish pressures provided by its descending resistance level. Following the breakdown below its ascending support level, as marked by the green rectangle, it moved below its horizontal resistance level, which magnified downside momentum. With this technical indicator below the 0 center-line, bears are in control over the USD/SGD.

While the Ministry of Trade and Industry (MTI) upgraded its 2020 GDP forecast, a challenging start to the fourth-quarter amid a deterioration in industrial production threatens the outlook. The descending Fibonacci Retracement Fan sequence maintains the bearish chart pattern in the USD/SGD. It started to move across its short-term resistance zone between 1.3466 and 1.3505, marked by the red rectangle.

A recent survey conducted by UOB showed that almost 50% of Singaporeans prefer to shop locally to assist COVID-19 hit companies. Numerous corporations stepped up assistance for small- and medium-sized enterprises (SMEs), further aiding the recovery process. The USD/SGD remains under breakdown pressures inside its support zone between 1.3368 and 1.3402, as identified by the grey rectangle. A correction into its next one located between 1.3213 and 1.3285 can materialize.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3380

Take Profit @ 1.3215

Stop Loss @ 1.3425

Downside Potential: 165 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.67

Should the Force Index reclaim its ascending support level, acting as resistance, the USD/SGD could experience a brief price spike. The upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level. With deteriorating conditions for the US economy and the US dollar, Forex traders should sell any rallies from current levels.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.3455

Take Profit @ 1.3510

Stop Loss @ 1.3425

Upside Potential: 55 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.83