With many countries struggling to contain the second wave of the COVID-19 pandemic, Singapore continues to display leadership. The highly disciplined Southeast Asian economy of nearly 6,000,000 has just 55 active cases and reports single-digit new daily infections. Despite the virus, the population remains patient, calm, and adheres to healthcare advice. The USD/SGD reversed a brief spike above its support zone, and a breakdown is pending amid the lack of bullishness.

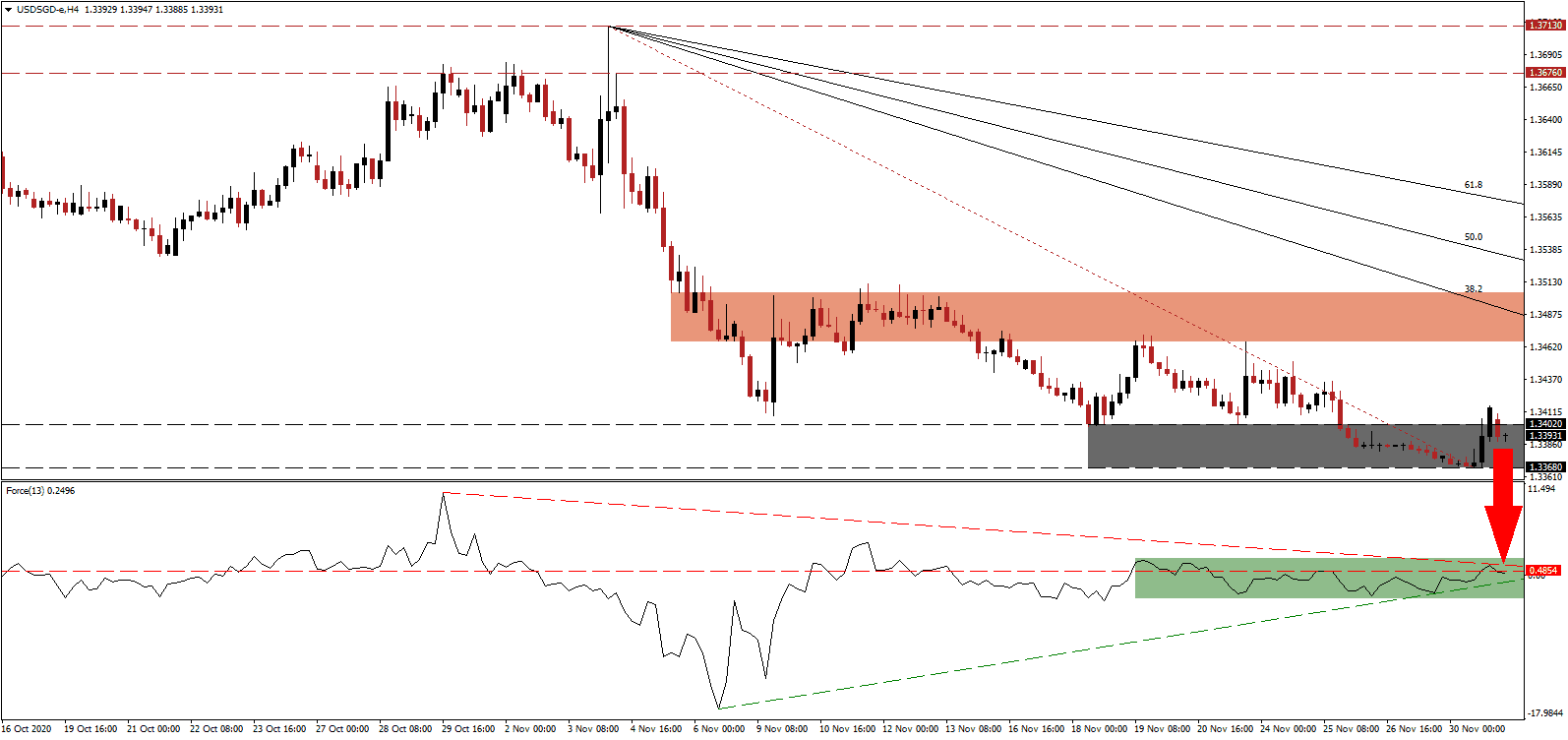

The Force Index, a next-generation technical indicator, reversed below its horizontal resistance level after recording a lower high, as marked by the green rectangle. It resulted in an adjustment to the descending resistance level, in position to pressure the Force Index below its ascending support level. Bears wait for this technical indicator to slide below the 0 center-line to regain complete control over the USD/SGD.

During the first four months of 2020, the Economic Development Board (EDB) of Singapore secured S$13billion worth of fixed asset investment commitments, a multi-year high. The Singapore Public Sector Outcomes Review (SPOR) confirmed that Singapore remains one of the most competitive and pro-business economies globally, with a high degree of trust. Following the twin rejection in the USD/SGD by its short-term resistance zone located between 1.3466 and 1.3505, identified by the red rectangle, bearish pressures expanded.

After the 5.8% third-quarter GDP contraction, the Ministry of Trade and Industry (MTI) raised its 2020 GDP forecast to a drop between 6.0% and 6.5%. It suggests a fourth-quarter recovery, while the outlook for 2021 calls for a rise in GDP between 4.0% and 6.0%. The descending Fibonacci Retracement Fan sequence maintains the bearish chart pattern. A breakdown in the USD/SGD below its support zone between 1.3368 and 1.3402, as marked by the grey rectangle, can take it into its next one located between 1.3213 and 1.3285.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3395

Take Profit @ 1.3215

Stop Loss @ 1.3440

Downside Potential: 180 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 4.00

A breakout in the Force Index above its descending resistance level can spark a brief short-covering rally in the USD/SGD. Given ongoing positive developments out of Singapore, together with intensifying negative ones out of the US, Forex traders should sell any rallies. The upside potential remains limited to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.3475

Take Profit @ 1.3530

Stop Loss @ 1.3440

Upside Potential: 55 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 1.57