New COVID-19 infections across South Africa continue to rise, and potential localized lockdowns may follow to contain the second wave of the pandemic. With the global economy under stress, India and South Africa seek to revitalize bilaterally by reducing the lack of information flow and contact between both BRICS members. The USD/ZAR remains under bearish pressures inside of its support zone.

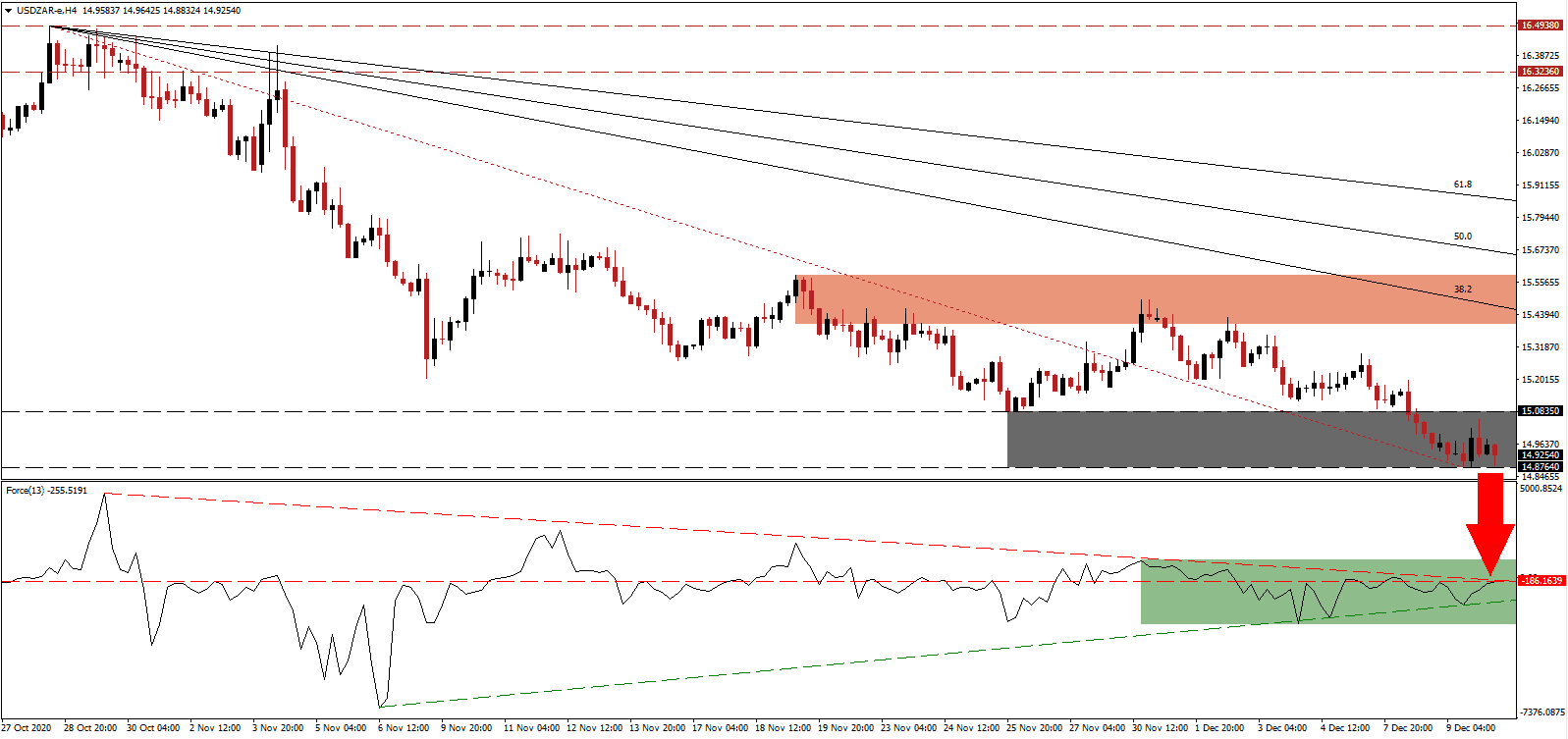

The Force Index, a next-generation technical indicator, bounced off of its ascending support level but now faces rejection by its horizontal resistance level, as marked by the green rectangle. With the descending resistance level adding to downside pressures, this technical indicator can reverse and drop farther below the 0 center-line. Bears remain in control over price action in the USD/ZAR.

Data from Statistics South Africa, the national statistical service, showed that the third-quartet GDP sky-rocketed by 66.0%, following the 52.0% plunge reported in the second quarter. The economy remains 5.8% below 2019 levels. The descending Fibonacci Retracement Fan sequence maintains the bearish chart pattern. It started to move through the short-term resistance zone between 15.4000 and 15.5805, as marked by the red rectangle.

With the Economic Reconstruction and Recovery Plan, championed by President Cyril Ramaphosa, as the cornerstone for the economy moving forward, more favor localization to strengthen economic progress. Positive momentum can spark a breakdown in the USD/ZAR through its adjusted support zone between 14.8764 and 15.0835, as identified by the grey rectangle, and into its next one between 13.8098 and 14.1426.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 14.9250

Take Profit @ 13.9250

Stop Loss @ 15.1250

Downside Potential: 10,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 5.00

A breakout in the Force Index, driven by its ascending support level, can initiate a minor short-covering rally in the USD/ZAR. The upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level. Forex traders should sell any advance amid a worsening short-term outlook for the US economy.

USD/ZAR Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 15.3000

Take Profit @ 15.6000

Stop Loss @ 15.1250

Upside Potential: 3,000 pips

Downside Risk: 1,750 pips

Risk/Reward Ratio: 1.71