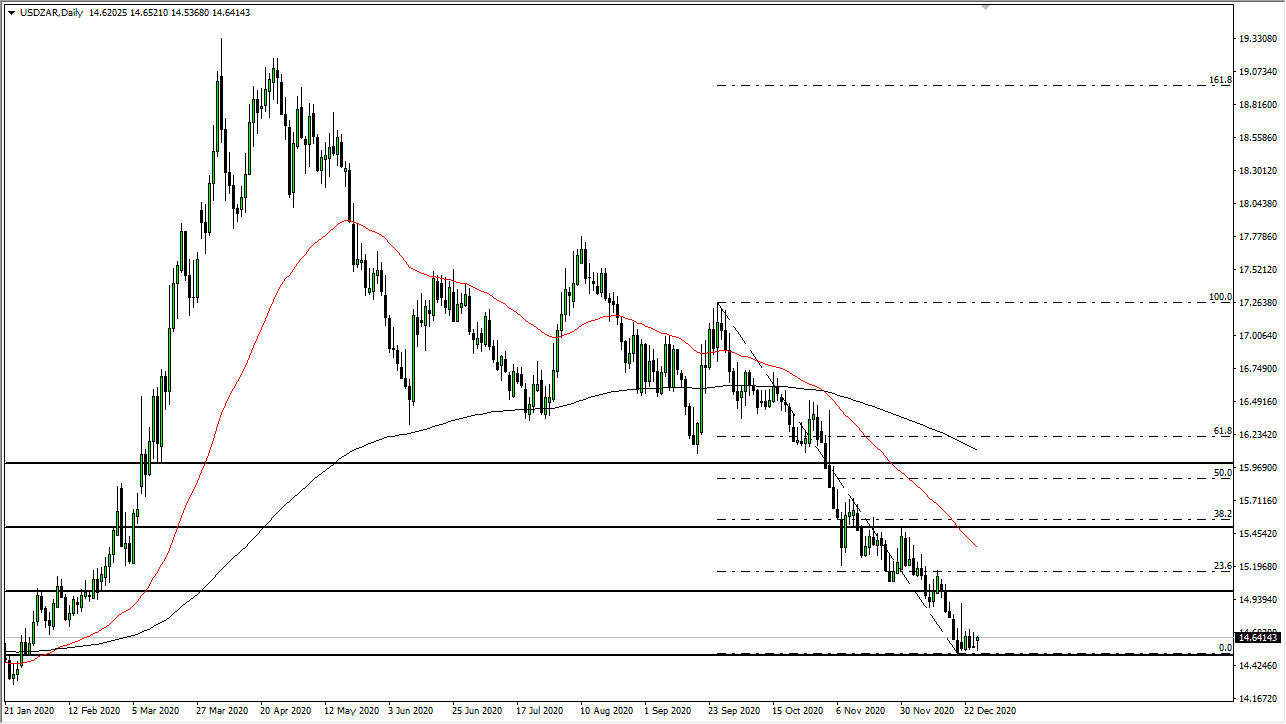

The US dollar fluctuated during the trading session on Monday as we sit just above the 14.50 rand level, an area that could continue to offer support as we are over-extended to the downside. We could see a bounce towards the 15 rand level, which has previously offered support. Beyond that, the market could then go looking towards the 15.50 rand level. I do not necessarily think that this is a market you should be buying at this point, but it certainly looks as if it is ready to cause a bounce. This makes sense, considering that the South African rand is one of the major emerging market currencies.

The US dollar has been oversold against many currencies, so some of these thinner currencies such as the rand will probably show quite a bit of movement. This will be especially true during the holiday season, as there are not as many people out there trading. There could even be profit-taking from those who went short the USD/ZAR pair, as it has been on a nice run.

If we do get a bounce, I suspect it is only a matter of time before we see signs of exhaustion that we can use to our advantage. The 50-day EMA sits near the 15.40 rand level, so that is also a candidate for resistance. Profit-taking into the end of the year would make sense, so I look at this as a potential setup for next year. I do not have any interest in trying to buy this pair, at least not until we break above the 16 rand level, something that we are quite a ways from doing. Furthermore, stimulus should continue to have people looking towards commodities, which the South African currency represents. Beyond that, it is one of the few currency pairs where you can actually turn a positive carry by trading, which makes the South African rand much more attractive than many of the other currencies around the world, despite the fact that we have seen coronavirus figures in South Africa look rather grim. At this point, it looks like Forex traders are starting to look past the virus in general.