The South African rand has been one of the better-performing currencies to pay attention to, as the US dollar has been absolutely pummeled against it. Looking at the chart, you can see that the US dollar initially spiked higher during the trading session on Monday, not necessarily as a result of anything going on with the South African rand, rather because everyone went running towards the greenback for safety. Keep in mind that the coronavirus mutations that we are seeing in the United Kingdom have spooked the market, so anybody and everybody were looking to get into the greenback as it is considered to be the “ultimate safety currency.”

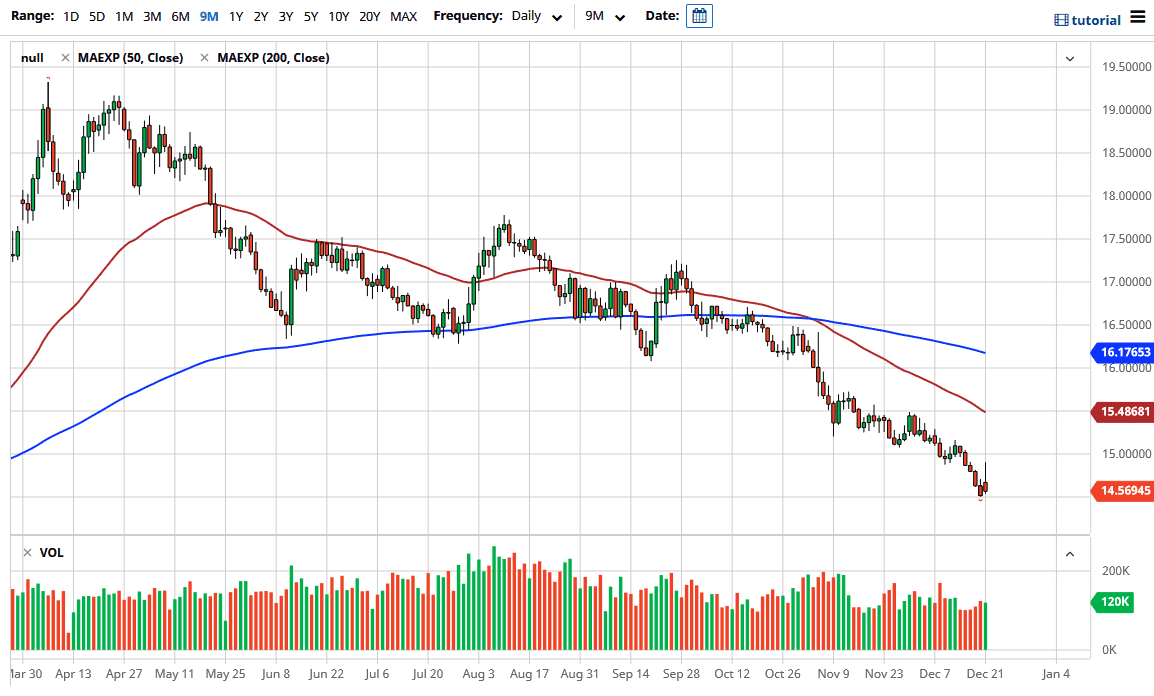

We needed some reason for the South African rand pullback, so the concerns about coronavirus on Monday will probably as good a reason as any. You will notice that the daily candlestick did reach towards the 15 ZAR level, but pulled back enough to form a massive shooting star. In fact, we ended up going negative by the end of the session, showing just how bullish the rand has become. Now that we are below the 15 ZAR level, which was an area that I had talked about previously, it looks like we have further to go.

The biggest problem you are going to have with the South African rand right now is that the liquidity is going to be so thin for about a week or two. The trend is very much decided, so it does make sense that you should look for opportunities to fade rallies, just as you got during the Monday session. It is obviously not easy to trade in emerging market currencies during holiday liquidity, so a lot of people will have missed the trade on Monday.

At this point, the market does tend to move in whole figures, so paying attention to a potential move down to the 14 rand level makes quite a bit of sense. It is not until we break above the 50-day EMA that I would be concerned about the downtrend, and at this time of year you have a lot of concerns about price moving far too quickly, so you need to keep your position size rather small. Regardless, buying is all but impossible, so it is probably only a matter of time until we get another selling opportunity.