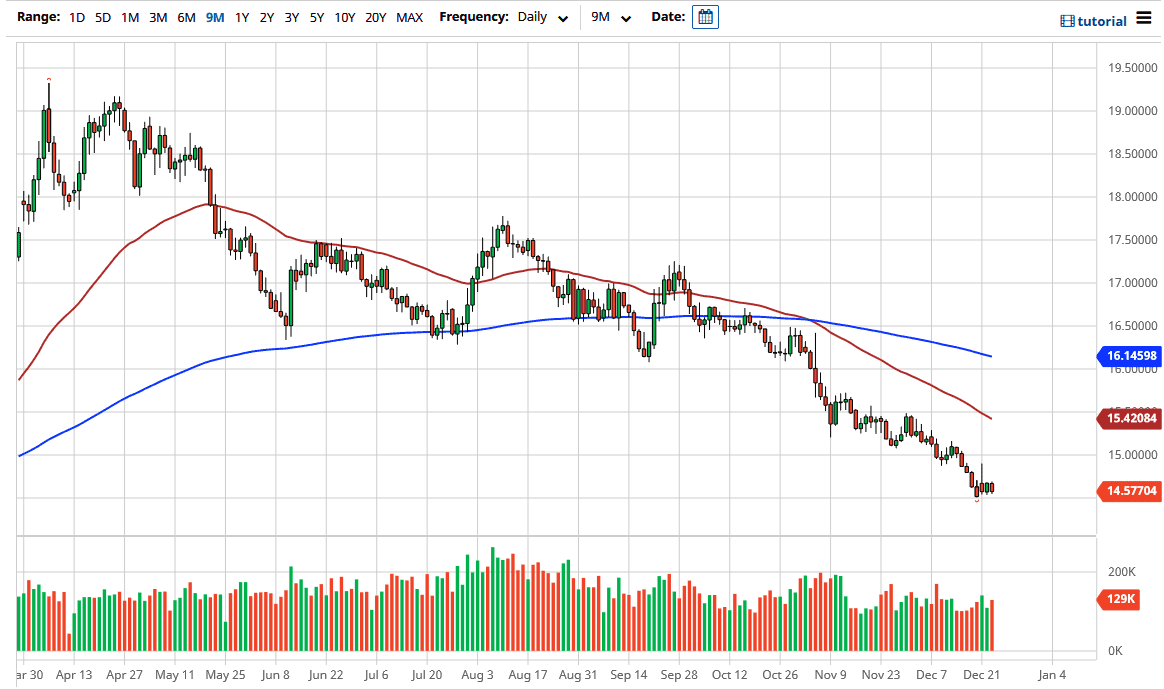

The US dollar fell against the South African rand during the trading session on Wednesday, reaching towards the 14.50 rand level. This is an area in which we have been killing time over the last week or so, but that is not too much to worry about due to the fact that it is Christmas week. Even if we do rally from here, the Monday candlestick formed a massive, inverted hammer, which suggests that we will continue to see sellers above. In fact, I think one of the biggest barriers above is the 15 rand level, which is sitting just above where the Monday candlestick approached but then failed from.

The 50-day EMA is sitting at the 15.42 rand level, and that would also be a selling opportunity. I have no interest in buying the US dollar against the South African rand, at least not anytime soon, as it looks like stimulus in the United States will continue to punish the US dollar in general. Remember, the South African rand is not only an emerging market currency, but is also considered to be a commodity currency as well, so it is worth watching.

The South African rand also is one of the better-paying currencies in the world right now due to interest rate differentials, and that helps because interest rate differentials are almost non-existent in most trades. This is a very strong downtrend and it looks like it has further to go, because although we have been dropping for quite some time, it has been slow and controlled. The rallies that could come from here should continue to attract plenty of attention and therefore it is worth looking for trades. If we break down below the 14.50 rand level, then the market is likely to go down to the 14 rand level. Furthermore, I think we will go even further than that, but it is going to continue to be a very controlled descent, not necessarily something that is going to be like a bottom falling out anytime soon. Given enough time, the US dollar will continue to see selling pressure against multiple currencies, not just this one.