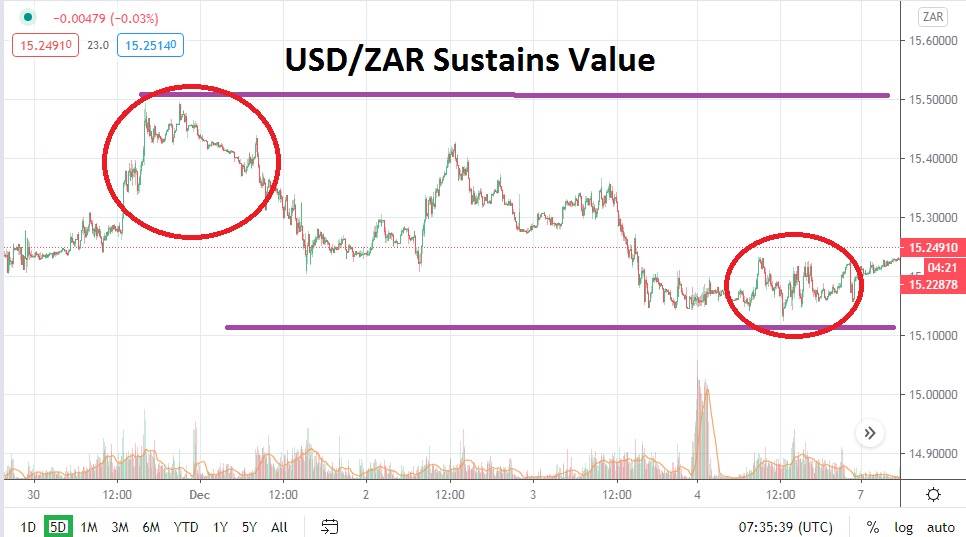

The USD/ZAR should be watched attentively short-term as it trades near important support levels which have proven adequate mid-term. The South African rand has sustained a solid bearish trend, but the past month of trading has produced several higher reversals when the 15.20000 to 15.10000 range has been tested. On the 26th of November, the USD/ZAR touched the 15.10000 juncture, but by the 30th of November the Forex pair hit resistance near the 15.50000 mark.

Speculators will want to keep their eyes on the ability of the USD/ZAR to sustain its value near the 15.20000 level today. When trading opened early there was a slight surge of bullish momentum higher, but interestingly, it did seem to run out of steam rather quickly. As of this writing, the USD/ZAR is traversing close to the critical support level as the 15.23000 value plays ping pong. Traders may not feel the urge to sell the USD/ZAR in its current price vicinity until it shows the ability to break below the 15.20000 mark and sustain the lower depths of its range.

The USD/ZAR, however, has been within a steady bearish trend and, although it has not quite yet proven the capability of penetrating support levels now being targeted, traders may want contemplate its short-term momentum via risk appetite perspectives. Before coronavirus fears struck the heart of the financial world, the USD/ZAR was trading within a value of 14.60000 to 14.90000 in February of this year.

Although South Africa certainly faces tough economic challenges ahead, so do many other nations. In fact, South Africa may not be too pleased to see the rand become too strong. However, the overwhelming influence within the USD/ZAR may be the erosion of value in the USD. This means that the USD/ZAR may continue to face further bearish pressure. Although the USD/ZAR may look over-valued to many analysts via fundamentals, the bearish trend may not be ready to relent and it may only be a question of time when the current support levels of the Forex pair will prove vulnerable.

Shorting the USD/ZAR on incremental rises of value by attentive traders may continue to offer a rather good speculative wager. Risk management should be used via stop loss positions near current resistance, but traders looking to sell the USD/ZAR may see support levels crumble and prove worthwhile positions.

South African Rand Short-Term Outlook:

- Current Resistance: 15.27000

- Current Support: 15.15000

- High Target: 15.34000

- Low Target: 15.10000