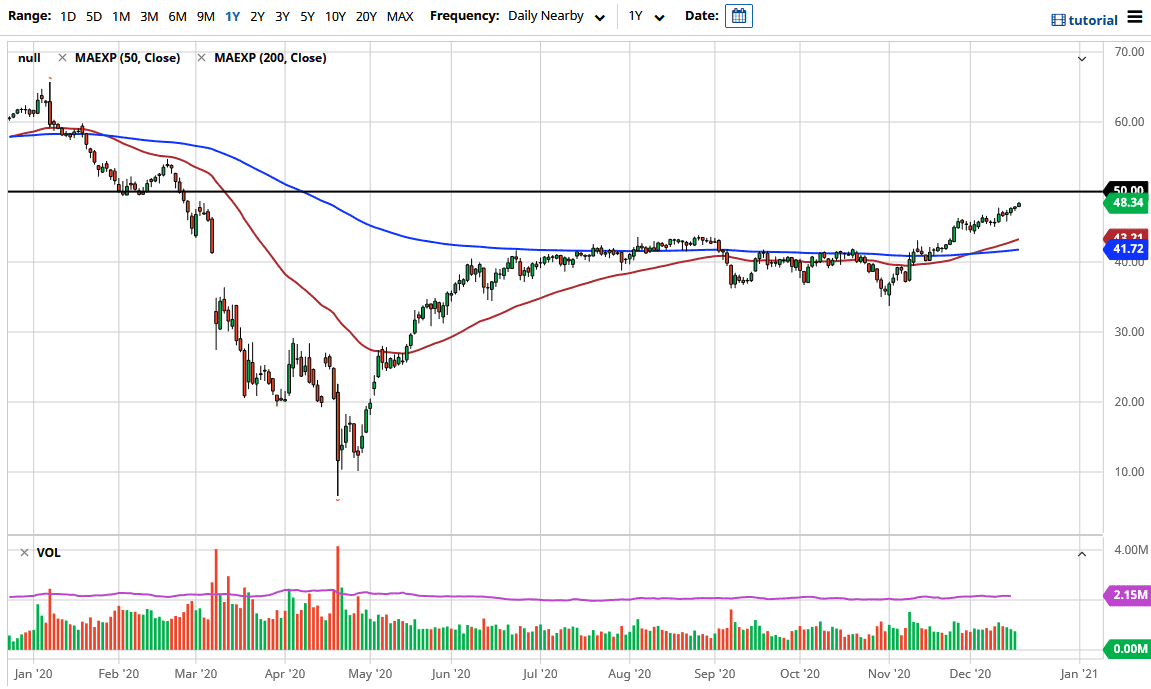

The $50 level has a certain amount of psychological importance built into it, so I do think that it is only a matter of time before traders will continue to do look at that as a potential place to take profit, and some people will be looking to sell crude oil at that region. Furthermore, a lot of traders will have taken a look at the gains that they have had recently and be willing to close things out ahead of the weekend.

Pay attention to the US Dollar Index, and where it currently sits. After all, the crude oil markets are measured in those US dollars, so it does have an effect on where price goes. Beyond that, we have to worry about demand, something that has been difficult to seem to pick up recently. That could at least be nudged along by the idea of stimulus, which of course people are paying attention to out of Washington DC. If we do get a sizable stimulus package, that could give crude oil enough momentum to break the $50 level, but right now I do not necessarily see that as a major driver for the longer term, but in the short term we could see a bit of a shot higher due to the usual “knee-jerk reaction.”

The biggest problem with crude oil is that longer-term we still have quite a bit of concern out there when it comes to demand, and of course there are a lot of lockdowns going on right now. Granted, production is less than it once was, but we are already starting to see the Baker Use Crude Oil Rig Count pick up, so that means that more supply will be coming online before it is all said and done. I think that short-term we are looking at a market that is probably going to continue going higher but longer-term we have a lot of concerns when it comes to longer-term demand. After all, there were demand concerns before the coronavirus pandemic, so now as things go back to normal, it is hard to imagine anything different.