WTI crude oil will enter January having achieved solid gains in December. The year of 2020 created memorable bedlam within the energy sector because of coronavirus implications as traders worried about the impact economically on the oil industry. The value of WTI crude oil achieved historic lows earlier in the year when the futures markets actually encountered negative pricing in April. However, as the calendar progressed, WTI found fundamental values and the past few months have returned to normal market conditions for speculators to participate.

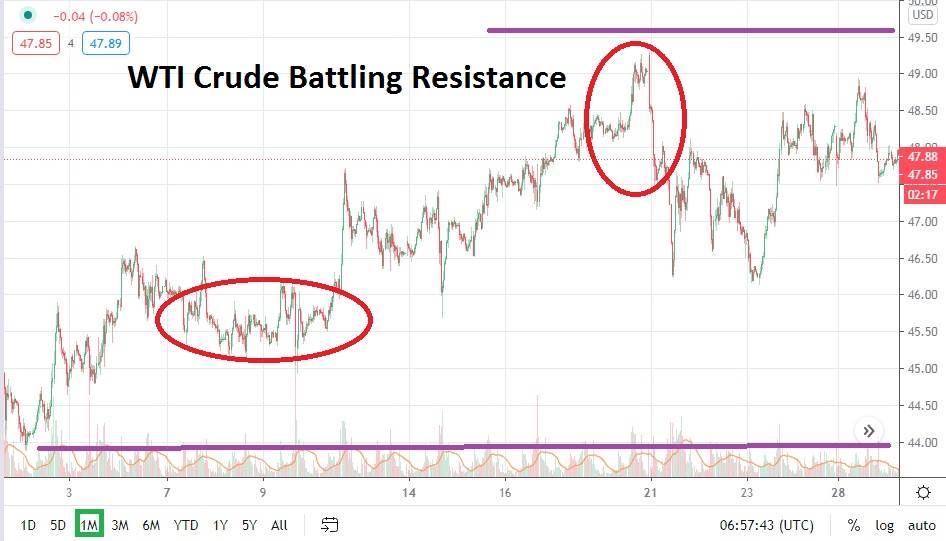

After seeing solid gains the first three weeks of December, WTI crude oil has seemingly run into resistance and seen its price fall from highs. While some traders may suspect that the drop in value the past week has occurred because of lighter holiday trading, other analysts are pointing to concerns regarding the potential from oversupply starting to be anticipated in the oil sector in the coming months. Russia and some OPEC nations are pushing to increase the amount of oil that can be produced. The shadow of too much oil supply in the market causes concerns because demand may not be enough to allow for a stable value in the commodity, meaning that too much supply could cause the price of WTI crude oil to lose value.

However, technically, WTI crude oil does continue to look rather strong and support levels have certainly proven adequate for traders. The price of 46.50 USD per barrel should be watched closely by speculators. If this juncture does not falter, it could create a base for traders to launch buying positions of the commodity if they have enough patience to wait for additional reversals lower. If a speculator doesn’t want to wait for the WTI crude oil to sink that low because they believe additional upside value will be attained quicker, the higher support level of 47.50 could be used as a closer target while looking for a pullback in the market. Using limit orders while looking for reversals lower as a springboard for long positions and quick profitable trades is a cornerstone of commodity trading.

The question buyers of WTI crude oil will have to wonder about is how high the commodity can climb if concerns about oversupply prove valid. 50.00 USD per barrel may prove to be an important psychological juncture. The last time the price of WTI crude oil traded within the 50.00 USD mark was in February of 2020 as coronavirus implications began to have an impact on commodity prices. Speculators should be cautious within the energy sector in January and it may prove wise not to anticipate gigantic gains and grab profits when possible.

Consolidation may develop for WTI crude oil in January. After achieving a steady rise in value the past few months the commodity has returned to what can be described as normal trading conditions. Yes, WTI crude oil remains under the value it traversed pre-coronavirus and some traders may believe those higher values are possible. However, it may prove worthwhile to be a buyer of the commodity within the energy sector on pullbacks in value using what has proven to be rather adequate support levels.

WTI Crude Oil Outlook for January:

- Speculative price range for WTI crude oil is 45.50 to 53.50 USD.

- Support at 47.00 USD appears solid, but if bearish momentum grows a test of 46.50 could develop and a potential low of 45.50 looks possible technically.

- Resistance near 49.00 USD appears to be a target but has proven strong recently, if the value is penetrated higher WTI crude could see a push towards 50.00. If the 50.00 mark is broken it could cause volatile speculation and a run up to 53.50 USD.