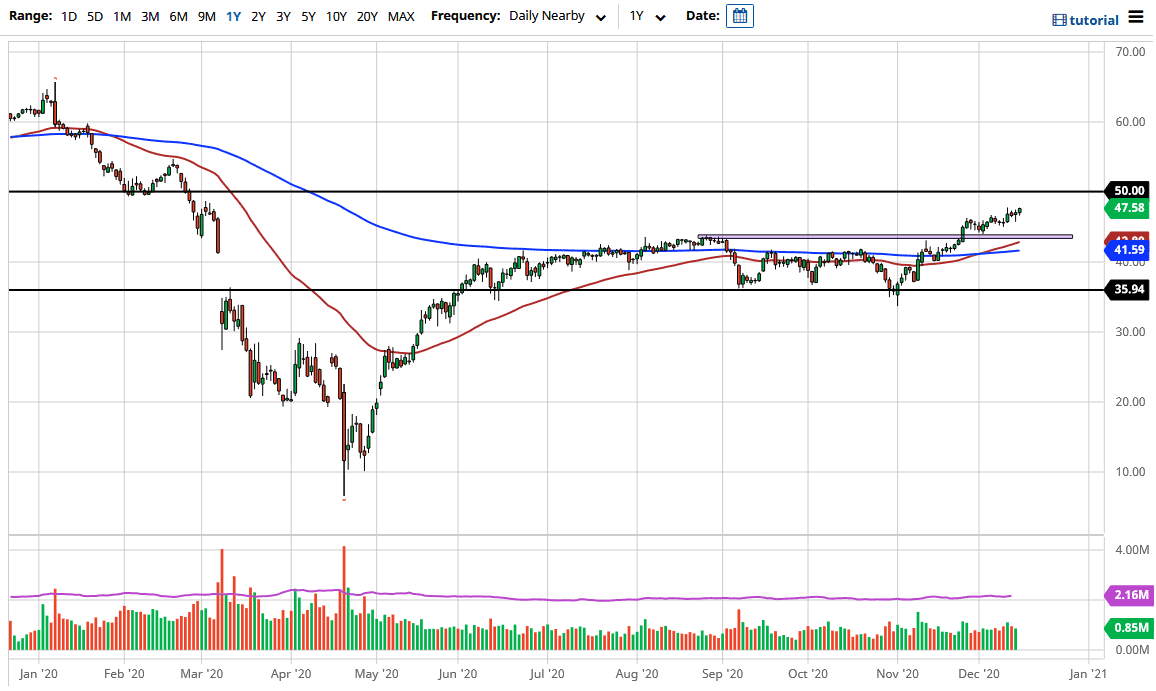

The West Texas Intermediate Crude Oil market rallied again during the trading session on Tuesday. Contributing to this are traders who are trying to front-run the Federal Reserve announcement on easing and monetary policy, as well as the congressional stimulus package that will come out in the next couple of days. The idea is that the demand for crude oil will continue to pick up. Whether that actually happens or not is a completely different question, but in the short term, we are taking a look at the possibility of running towards the $50 level. This is a short-term trade, because longer term we will continue to see a lack of demand.

Stimulus cannot fix what's going on right now. There has been so much damage to the global economy and, perhaps even more importantly, the US economy on the whole, that crude oil - WTI especially - could be soft for some time. In fact, Exxon recently suggested that they are anticipating a lull in crude oil pricing for at least the next few years. Exxon would obviously have good insight into this, so it is worth paying attention to that.

If we do break above the $50 level, then we have to start to look at the $52.50 level as a potential target. However, what we will probably see at the $50 level is a lot of selling pressure. It is a large, round, psychologically significant figure, so people will be paying close attention to it. But it is worth noting that, at the very least, traders will try to test that resistance barrier.

Underneath, we have the $43.50 level offering support due to the fact that it was previous resistance and the fact that the 50-day EMA sits just below there. This is a market that remains a “buy on the dips” scenario, as momentum and a bit of euphoria seem to be taking over. Longer term, we will see another collapse in the oil markets like we did earlier this year. Perhaps not with the same type of ferocity, but most certainly I would see a deep correction.