The West Texas Intermediate Crude Oil market had a rather volatile day as the market ended up forming a neutral candlestick. Initially, the idea of more stimulus coming out the United States sent crude oil higher, but by the end of the day nothing had gotten accomplished, and we had the inventory numbers coming from the Department of Energy. Crude oil gained 15 million barrels in the biggest build of inventory since April, much more than the expected 700,000. Gasoline was up 4.22 million barrels which is also the biggest build in supply since April. Distillates rose 5.22 million in their biggest build since the month of May. All this suggests that perhaps demand is falling off of a cliff in the United States, which has a significant knock on effect around the world.

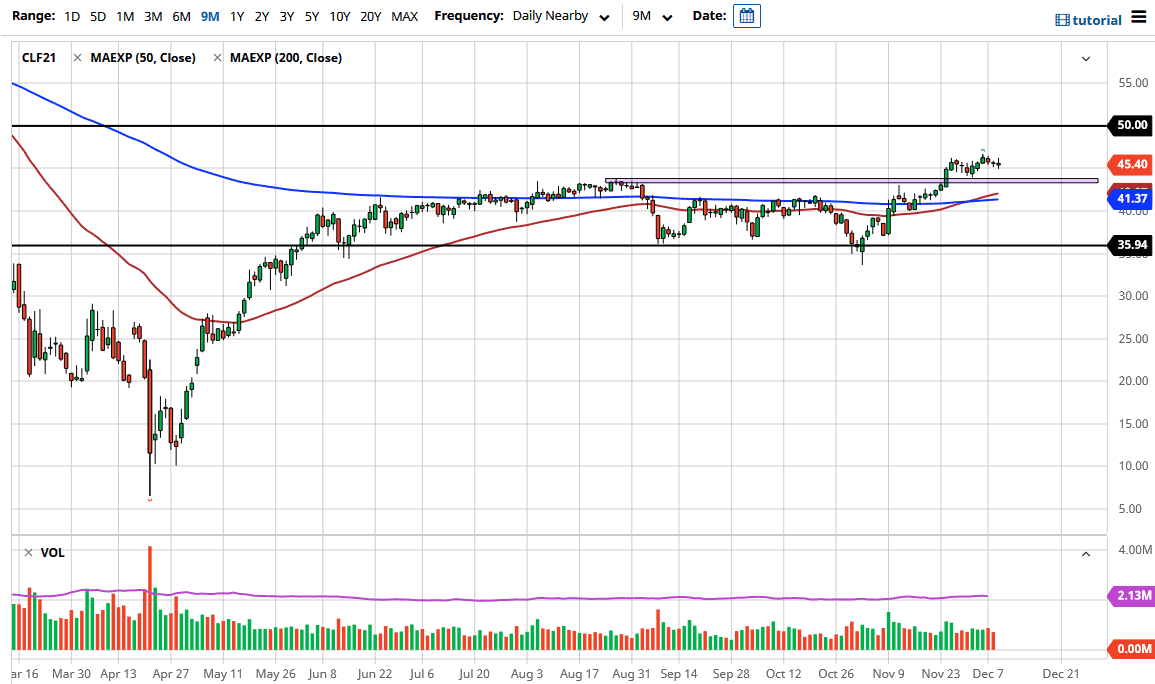

Stimulus could cause a bit of a jump, but it appears that the market is simply satisfied to sit here just above the recent break out at the $43.50 level. The market will likely continue to be very noisy and move on the latest headline. Short-term pullbacks will probably be bought, because many traders are still looking past the vaccine toward a lockdown-less world. What they are not focusing on is the fact that many businesses have been permanently damaged/destroyed. However, I am not going to argue with them; I am simply going to buy dips in the meantime. The $50 level above probably offers a fairly solid ceiling, but will see when we get there. Pullbacks continue to find traders who are looking for some value, so I am not really interested in shorting this market quite yet. People will start to notice that supply still far outweighs demand, and then eventually they will start to price the markets accordingly. You cannot fight these exuberant crowds, no matter what the fundamentals say. If you want any confirmation of this simply look at the NASDAQ 100 over the last 12 years or so.