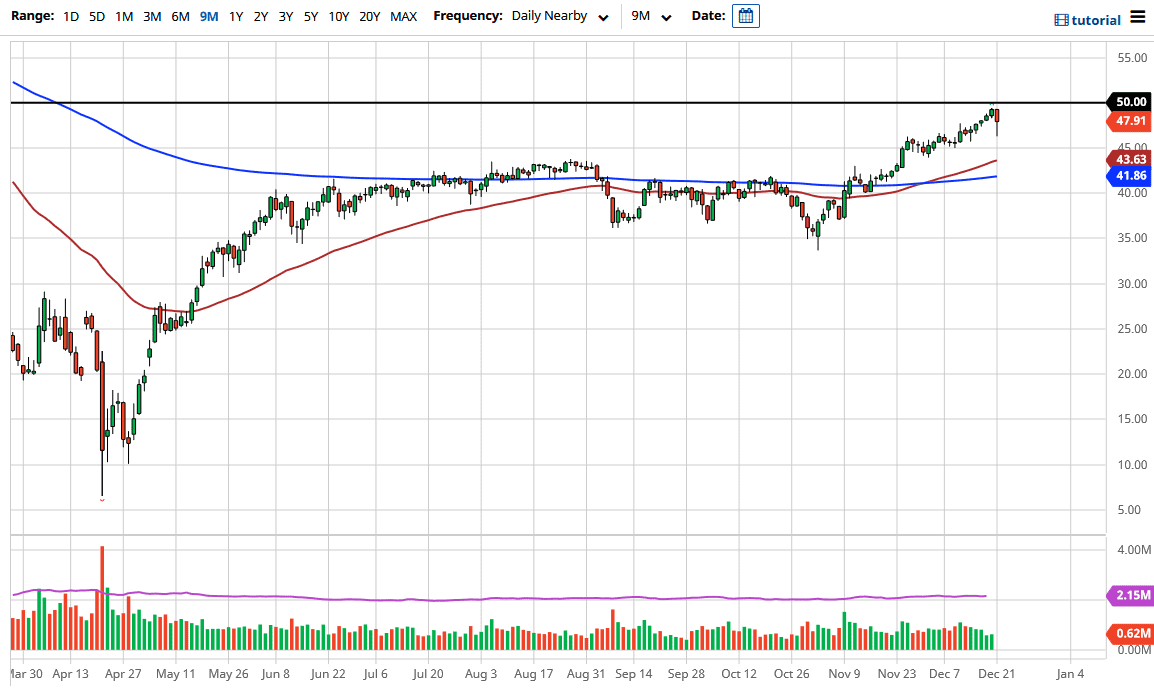

The West Texas Intermediate Crude Oil market fell quite a bit during the trading session on Monday as traders worry about the coronavirus mutations in the United Kingdom. The mutations are leading to harsher lockdowns and perhaps even slowing down commerce between the United Kingdom and the European Union. Because of this, the idea is that there will almost certainly be less demand. This is a market that has been in a move to the upside for some time, but the $50 level above is significant psychological resistance.

Crude oil has fallen rather hard due to people running towards the US dollar, which works against the value of crude oil sometimes, as the barrel of oil is priced in that currency. That does not mean that we have to have that type of correlation, but it is quite often the case. Underneath, the $45 level should offer support, and we will probably continue to find that area as attractive to buyers. We have seen that area as support previously, so it does make sense that it would act so currently. The market will try to break through the $50 level, and if we continue to see US dollar weakness, it is possible that that may happen.

The US Congress has the votes to pass a stimulus package, so the idea is that perhaps there will be more demand for crude oil, and the devaluation of the US dollar will be a major factor as well. The candlestick does show that we have recovered quite nicely during the trading session, and it suggests that there is pressure underneath that is trying to break out. If we can get that kicked off, we could get a move towards the $52.50 level, possibly even the $55 level after that. To the downside, I think that not only does the $45 level offer support, but so does the 50-day EMA, which is sitting just below it. I have no interest in shorting oil, at least not right now. Given enough time, the markets will eventually flash a longer-term sell signal, but right now we aren't anywhere near that, so short-term dips will continue to be bought into. However, keep in mind that this is the holiday week, so volume is going to be a major concern.