The West Texas Intermediate Crude Oil market pulled back during the trading session on Wednesday as we continue to see a lot of volatility in the markets. Much of this is probably because markets are hoping for stimulus to be passed in the next few sessions. The question is whether or not there will be enough stimulus to shock the markets. There are a couple of different reasons to think that perhaps the crude oil markets will get a bit of a boost.

The first reason is simply the US dollar falling due to the stimulus. Remember, the crude oil markets are priced in US dollars, so it takes more US dollars to buy a barrel of crude oil if we have a falling US dollar. This is a simple currency tailwind, but there is also the possibility of increased demand due to the stimulus package. I am not necessarily a huge fan or proponent of that, but I recognize that the market is starting to focus on that.

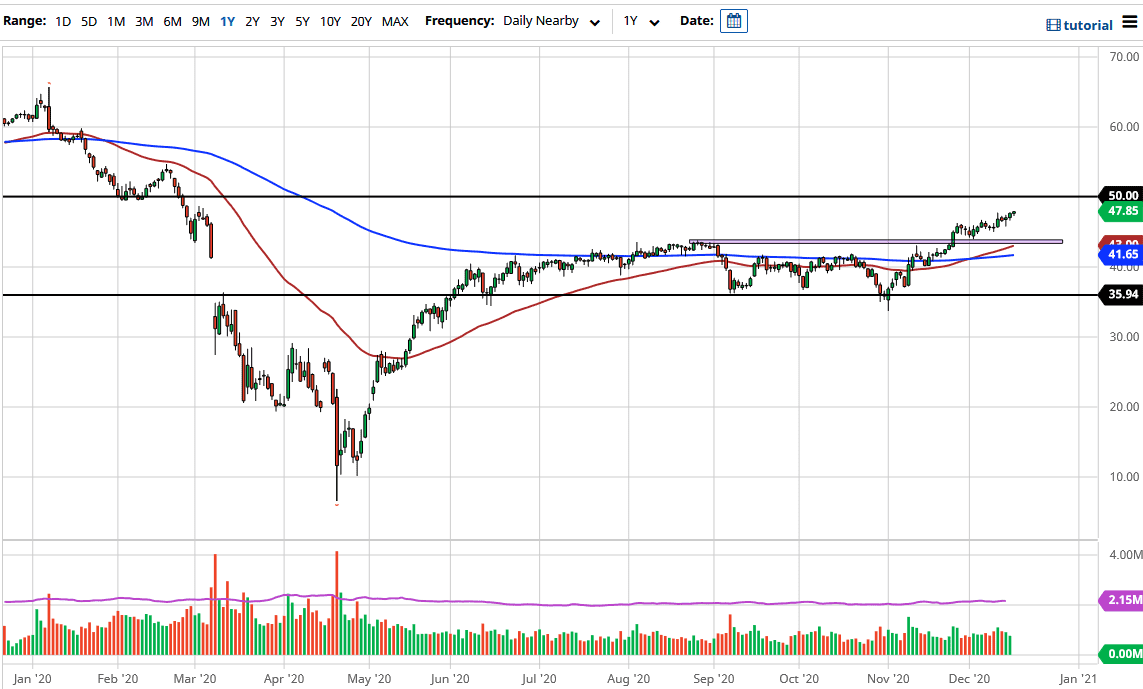

Longer-term traders will be paying attention to the red 50-day EMA breaking above the blue 200-day EMA on the chart, which is the so-called “golden cross” to which those traders pay attention. If you are using that moving crossover system though, you will find yourself losing money. Looking at the chart, I think the $50 level makes sense when it comes to resistance, not only due to structure but due to the large, round, psychological nature of the $50 level as well. If we were to break above there, the market could go looking towards the $52.50 level, but we have some serious work to do to get there.

The candlestick is slightly reminiscent of a hammer, but let's be honest: it is simply in an uptrend, so there is no point in trying to overcomplicate this situation. I believe the $43.50 level continues to be a short-term “floor in the market”. Pay attention to the US Dollar Index, because if it continues to fall, that might be reason enough to send this market higher, not to mention the fact that stimulus could send it over the edge to the upside.