Crude oil markets were slightly negative during the trading session on Monday as we came back to work, mainly because we are waiting for the announcement from OPEC. They are in the midst of a two-day meeting, and there has been more than one headline out already suggesting that a few members are not quite on board with production cuts, or at least not willing to go along with what was originally projected. (I'm looking at you, UAE and Kazakhstan.)

But we have recently broken through a significant amount of resistance, so it is likely that there will be some momentum chasing in the short term. Sure, OPEC will almost certainly agree to some type of cut back in production, but the question then remains whether or not there will be enough demand to take down that supply. That is where the true rub lies: although crude oil may be positive in the short term, the reality is that even with a vaccine coming, the demand for crude oil is still weak. In fact, it was weak before the pandemic, so it is hard to believe that suddenly everything has changed. Yes, oil will go higher from here, but the question then becomes: for how long?

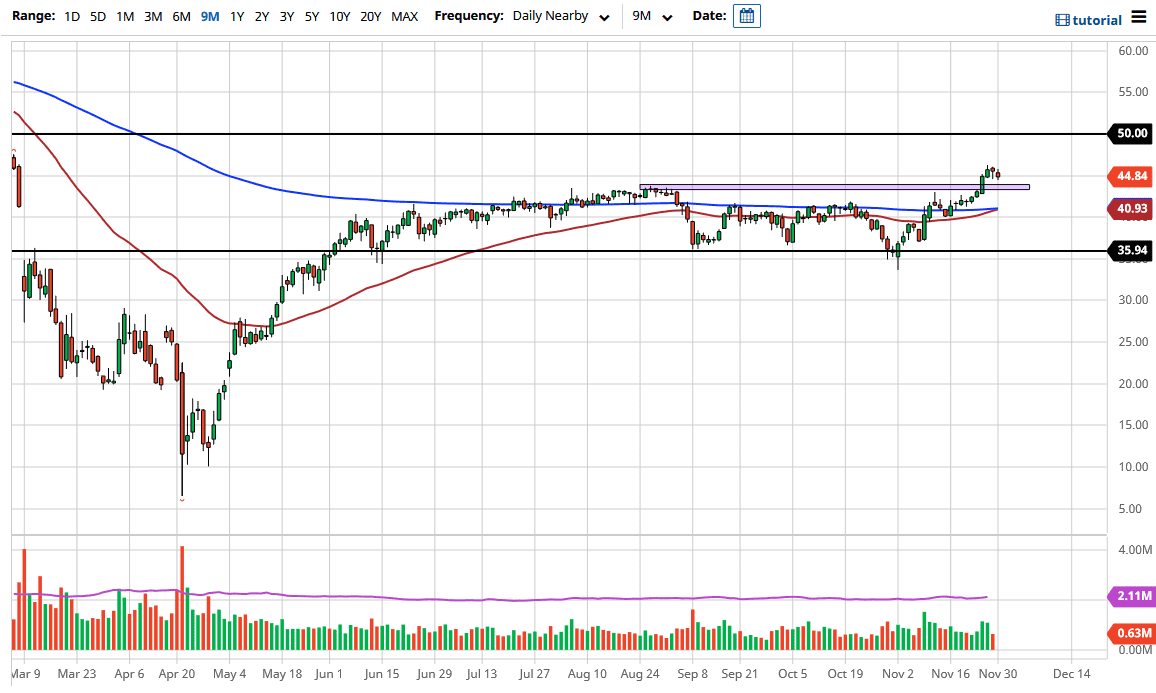

There is a major potential for a bit of a short squeeze in the short term, and that is what I am watching. I believe that pullbacks will be bought into, and then we could go looking towards the $50 level. At that level, one would have to think that there is a certain amount of psychological resistance, and therefore some selling pressure. Whether or not we get above there is a completely different question. But in the short term, that has to be your target. We have already heard a bit of noise around the $45 level, but it is worth noting that underneath that, the 50-day EMA is starting to cross above the 200-day EMA, so some longer-term investors may get involved. I do not see a scenario in which I would be a seller quite yet, but longer term, I still think crude oil has a lot of issues that will have to work through.