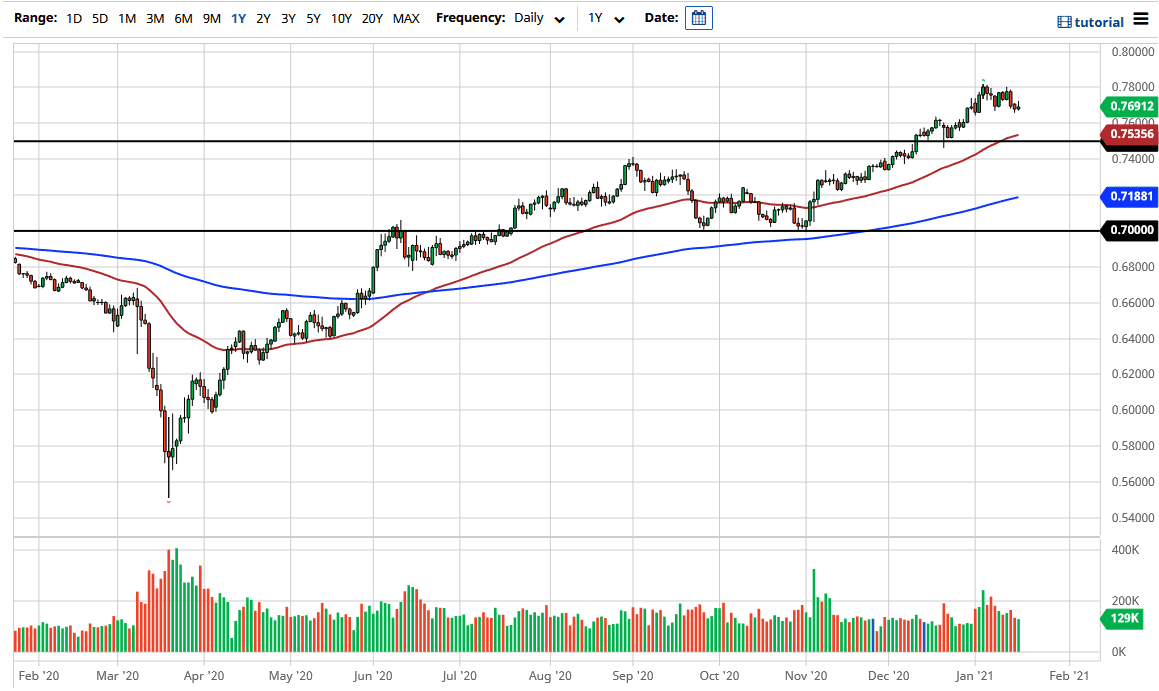

The Australian dollar initially tried to rally during the trading session on Tuesday but then gave back the gains to form a shooting star-shaped candlestick. If we break down below the candlestick from the previous session, it is very likely that the Aussie will continue to go a bit lower, perhaps reaching down towards the 0.76 level, maybe even as low as the 0.75 handle. Furthermore, the 50-day EMA is sitting above the 0.75 level, and it is very likely that we will continue to see buyers pick up little bits and pieces of value in a market that certainly has much further to go.

Looking at this chart, I think that if we drift lower, there will be a lot of value hunters underneath there willing to get involved. The US dollar has been a bit oversold, so it makes sense that we get some relief at this moment. The Aussie is tied to the idea of inflation and the reflation trade, as well as commodities. You should continue to look at this is a market that will continue to be noisy but positive over the longer term.

To the upside, the 0.78 level has offered a bit of trouble for buyers, and what we are looking at here is an opportunity to go even more bullish if we can break above there. If we can, the market then will go looking towards the 0.80 level. The 0.80 level above is a large, round, psychologically significant figure, and that is something that we should be watching. If we break above there, then the market is free to go much higher over the longer term. In the meantime, we will see a lot of choppy behavior. The market is simply trying to digest massive gains from previous trading, and it will eventually find plenty of buyers. In fact, I do not really have a scenario in which I am looking to short this market, at least not for anything more than a quick smash-and-grab type of trade.