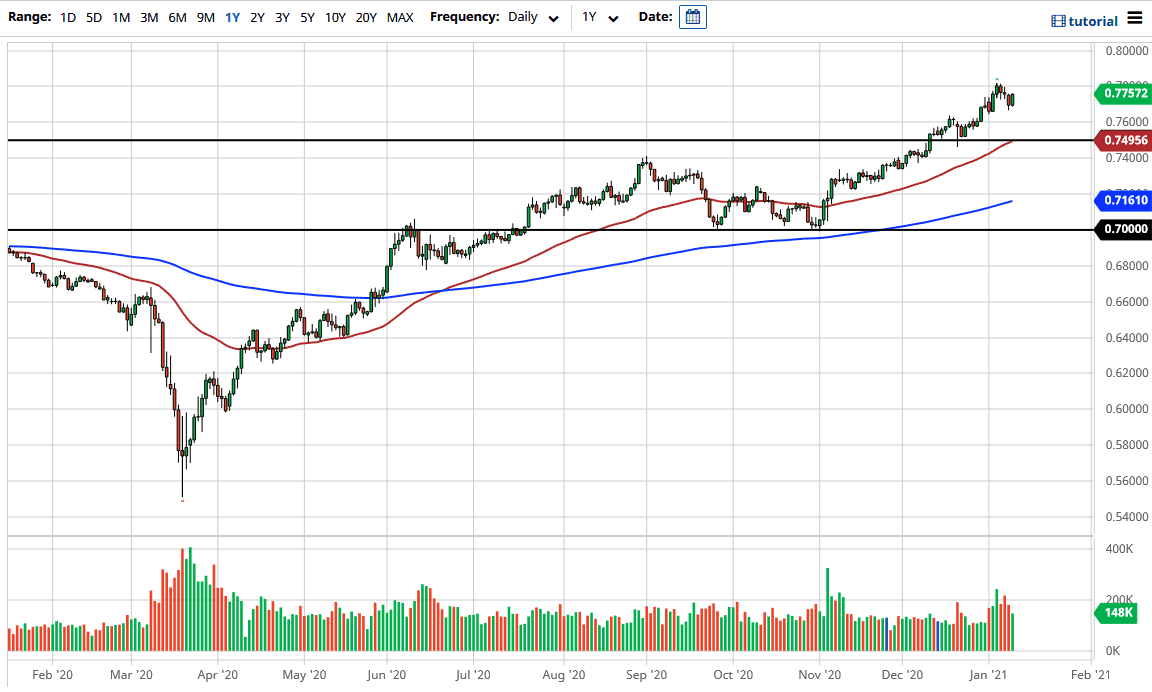

The Australian dollar rallied a bit during the trading session on Tuesday as we continue the overall uptrend. At this point, the US dollar has been slightly positive over the last couple of days, but given enough time, we should continue the overall selling of the greenback. Pullbacks will continue to offer value that the market will continue to jump into, and perhaps try to drive towards the 0.80 level above.

To the downside, the 0.75 level is massive support, assuming that we even get down to that level. The 50-day EMA sits there as well, so it is an obvious place where a lot of value hunters would get involved. The size of the candlestick is also somewhat bullish, so I do like that as a potential signal that we will continue to go higher. The fact that we are closing at the top of the candlestick does not hurt the argument either, and the size of the candlestick suggests that the market is probably ready to continue the overall uptrend. Therefore, I think the US dollar itself is going to be sold off against most other markets.

We have seen a turnaround in the gold market during the trading session as well, which also bodes well for gold. Copper has had another strong showing, which suggests that we could go higher in this pair also, due to the fact that the Australians are such huge providers of copper to places like China and most of the other manufacturers worldwide. I have no interest in shorting this market, unless we break down below the 0.75 level at the very least. Regardless, when you look at the action over the last several months, we have been in a very steady incline, and that continues to be a good sign that we are going higher. Gold has not been straight up in the air; rather, it has been more or less a gentle gain from time to time. This is all about commodities more than anything else, so make sure you pay attention to a lot of commodity markets that are based upon hard assets, as well as the US Dollar Index, which can also give you an idea as to where the greenback is going.