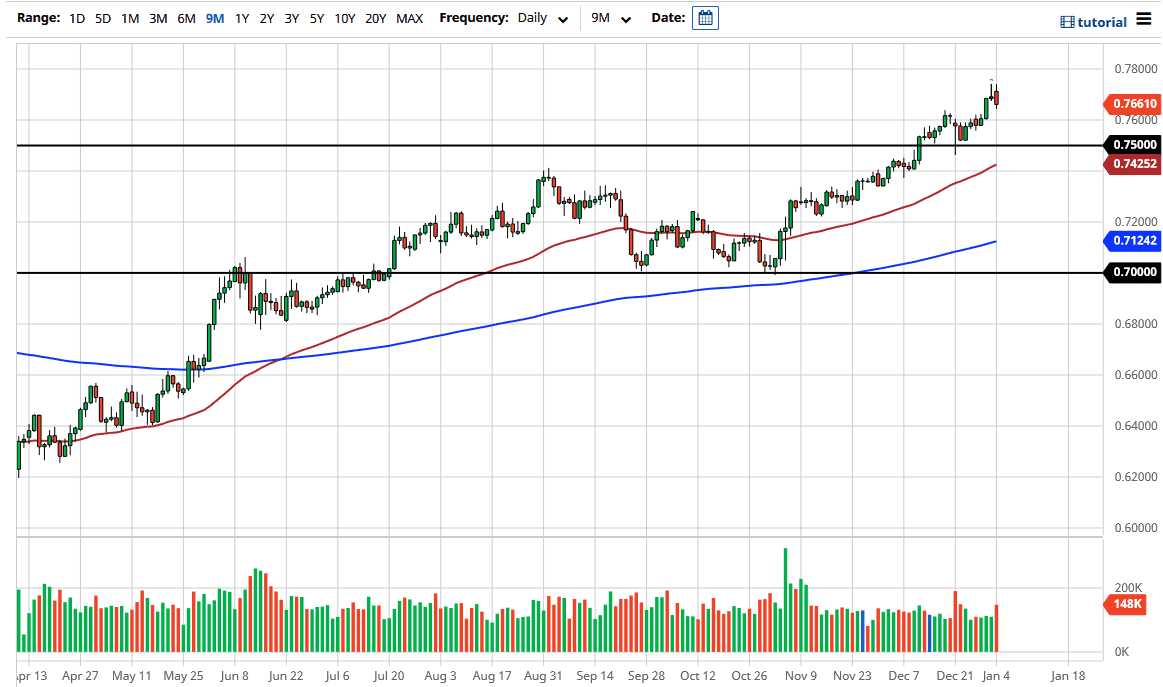

The Australian dollar initially tried to rally during the trading session on Monday, but gave back the gains at the highs from the Friday candlestick. That sits just below the 0.7750 level, which is an area where I anticipated we could see a bit of profit-taking. We are looking at a scenario in which the Australian dollar continues to be a “buy on the dips” type of market, so I am particularly interested in large, round numbers underneath such as the 0.76 level, and even more so at the 0.75 handle. The Australian dollar will get a boost by the gold market rallying the way it has been, and I think that given enough time, we will see that correlation play out again.

The sudden spike higher in gold during the trading session on Monday was probably more to do with safety, considering that the US dollar also rose at the same time. This can and will happen occasionally, but the longer-term correlation tends to hold that a falling US dollar helps the gold market. It is not the be-all and end-all, but it is something worth paying attention to. The attitude of the market will continue to be one that favors the upside longer term, due to stimulus coming out the United States. This is probably more or less going to be a run towards safety during the trading session, but traders are still coming back to work from the holidays, so the next couple of days could be somewhat choppy but eventually the overall trend should continue. To the upside, I believe that the 0.7750 level being broken opens up the possibility of a move towards my long-term target of 0.80. However, the first couple of months of 2021 are probably going to be very choppy, to say the least.

It is not until we break down below the 0.74 level that I become concerned with the overall uptrend of this market, something that I do not see happening very easily. For what it is worth, the 50-day EMA sits just above that figure as well.