The Australian dollar has done very little during the trading session on Monday to kick off the week. The market is busy killing time, as it had gotten ahead of itself. When we go sideways like this, quite often position building is what is going on, and I think that is the case here. The Australian dollar is trying to get to the 0.80 level, but it is going to take a significant amount of work to get there. We have a little bit more sideways action ahead of us, especially as we continue to debate whether or not stimulus will be big enough to satiate the overall risk appetite of traders around the world.

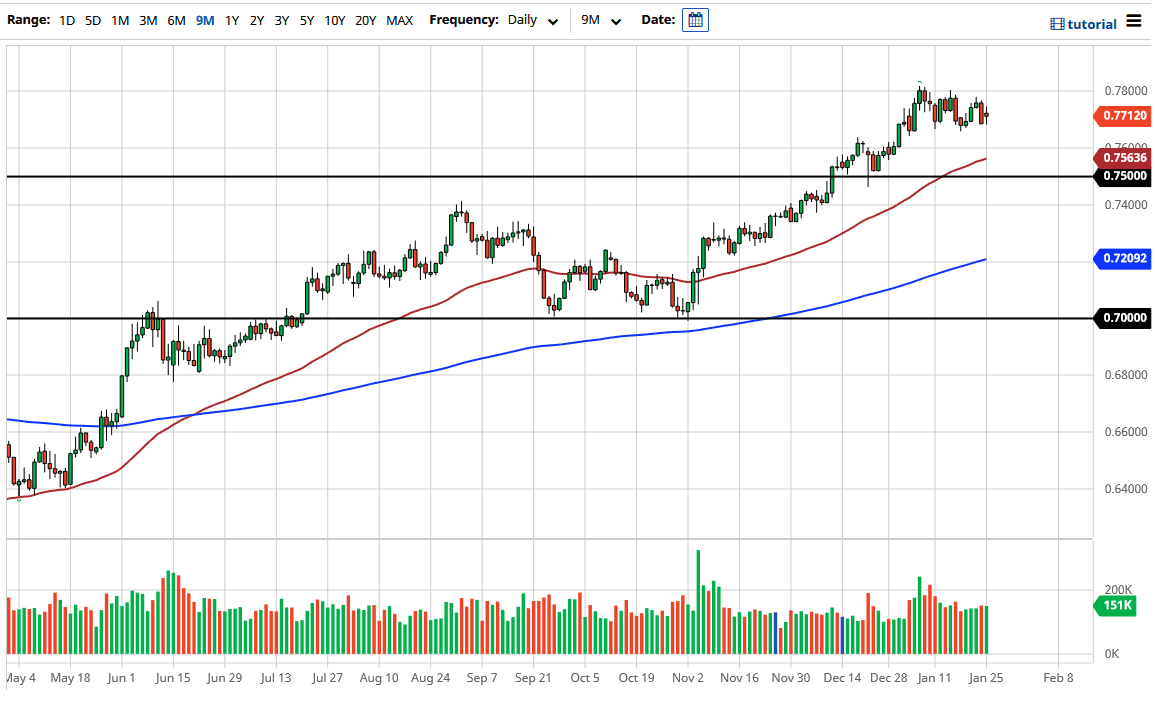

Below, I see the 0.76 level as the beginning of significant support extending all the way down to the 0.75 level. Furthermore, not only is the 0.75 level a large, round, psychologically significant handle, but it is also where we see the 50-day EMA slicing through. I believe that the combination of the two will probably send this market higher on some type of bounce from that area. This is all predicated upon the US dollar getting hammered due to stimulus, and an increase in the overall inflationary issues around the world, as commodities become much more expensive.

If the push by central banks to flood the markets with liquidity continues to work, that will significantly impact a lot of the main exports coming out of Australia, and thereby drive up the demand for the currency. Many traders will look at this as one of the best currencies to own, so I think that it will naturally go looking towards that 0.80 level. If we can break above there, then it could kick off the next major leg higher in this market, perhaps allowing the market to go even further than we imagine at the moment. Keep in mind that this could be the beginning of a multi-year inflationary trade, in which case we could have quite a while to go. The Federal Reserve seems hell-bent on trying to destroy the US dollar, and I suspect that they will probably be successful before it is all said and done.