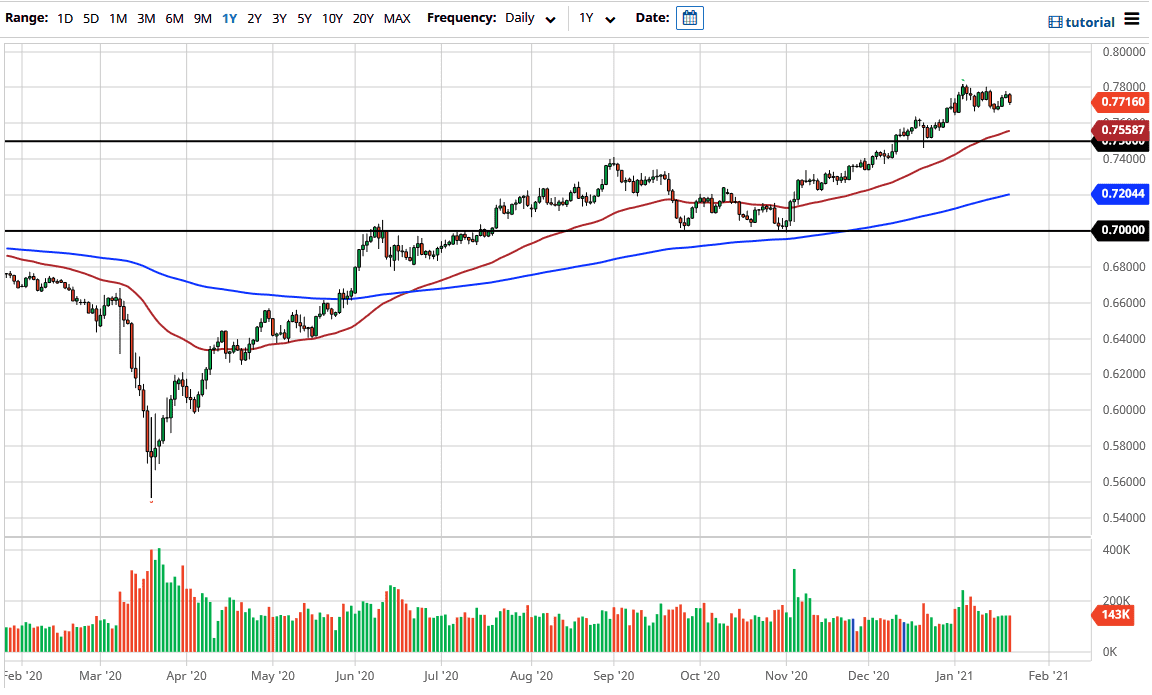

The Australian dollar pulled back a bit during the course of the trading session on Friday as it looks like the 0.78 level can be thought of as significant resistance. It is a bit interesting watching this pair, because it is so highly tied to the idea of stimulus. The Australian dollar being highly levered to commodities makes the idea of a large stimulus out the United States a rocket fuel for this pair. Not only do you get the benefit of exposure due to the Australian dollar, but you also get a softening US dollar due to the fact that there will be significant spending.

The market has been in an uptrend for quite some time, so it would not be a huge surprise to see that it pulled back a bit in the interim. It simply needs some type of catalyst in order to make it happen. The fact that several Republicans in the U.S. Senate have suggested that stimulus can be put on hold at the end term suggests that we may see a bit of a revival for the greenback. The US dollar has been oversold for some time, so it is likely that we will see a potential for a pullback that gives value people are looking for.

I believe that the 0.75 level would be a very interesting place to get involved, due to the fact that we not only have the large, round, psychologically significant figure, but we also have the previous resistance, which now should offer significant support. Furthermore, the 50-day EMA sits here as well, and a lot of people will be looking at this as an opportunity to get long. To the upside, the 0.80 level will be targeted given enough time, due to the fact that it is a magnet for price on longer-term charts, and this is probably going to continue to see a lot of interest longer-term based upon the idea of increased spending. However, the market may have gotten ahead of itself due to the fact that the size of stimulus coming out of Washington is a question at this point. I do not have any interest in shorting this market quite yet, and I believe that eventually, we will find enough stimulus to turn this thing around.