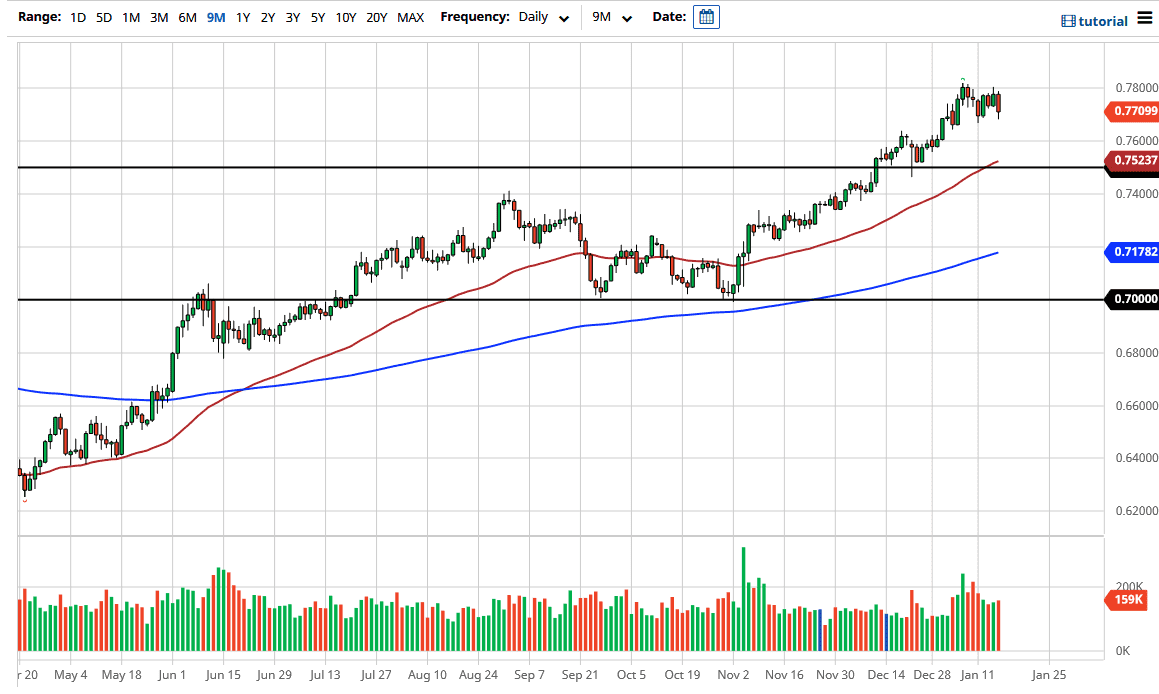

The Australian dollar has pulled back from the highs again during the trading session on Friday as we continue to see the market graduate in general. The 0.78 level is an area that has been difficult to break above, but if and when we do, it should send the Aussie dollar looking towards the 0.80 level. The market has been going back and forth in this general vicinity trying to digest the gains that we have taken to the upside and could even be thought of as a potential flag. Nonetheless, I like the idea of buying this market and not selling it.

The 50 day EMA has broken above the 0.75 level, and I think that is essentially the “floor in the market” in the Aussie dollar, as it was not only a large, round, psychologically significant figure that has been broken out above, but it also is an area that features the 50 day EMA as well. All things being equal, I think that a pullback to that area would make an excellent buying opportunity, but you can see that we did recover a bit towards the end of the day on Friday, so I think that we will find buyers on dips anyway. I have no interest in shorting this market, unless of course something changes drastically from a macroeconomic standpoint.

I think at this point in time it is likely that the “reflation trade” will continue to be the main reason why we continue to push this market higher given enough time. However, that does not mean that we cannot pull back a bit, but at the end of the day the US dollar is going to continue to suffer from spending, be it the $1.9 trillion that Joe Biden has been asking for, or if it is something closer $1.1 trillion like Goldman Sachs thanks will happen. At this point, were in an uptrend and that is the thing that you need to pay attention to the most. If we broke down below the 0.75 handle, then it is possible that we could be looking at a trend change, but until that happens, I would not be concerned about dips. As far as buying right here, that is possible, but I would do so with a relatively small position to follow the trend.