Sell case

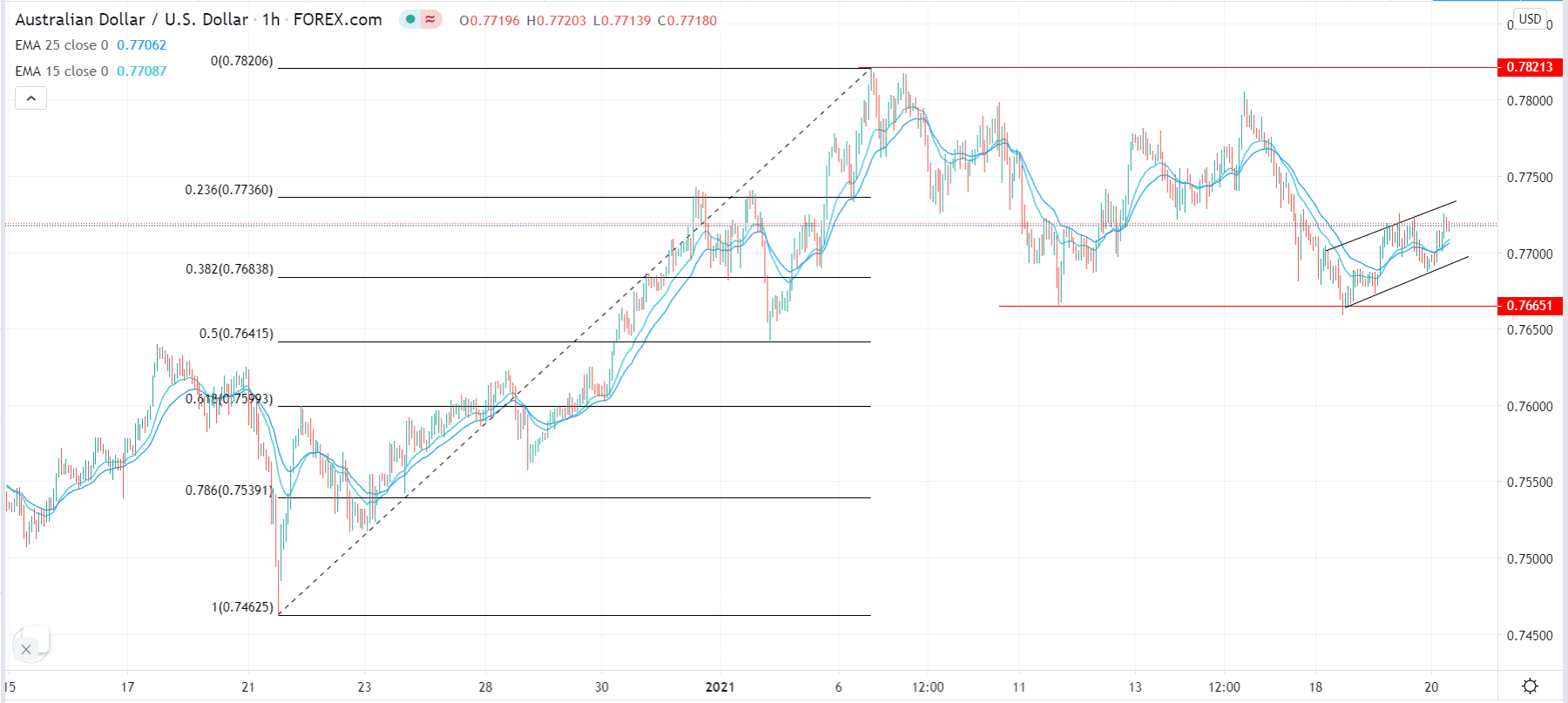

Set a sell limit at 0.7730, which is the upper side of the channel.

Have a take profit at 0.7687; the lower side of the channel.

Add a stop loss at 0.7750.

Bull case

Set a buy stop at 0.7750 and a take profit at 0.7800.

Add a stop loss at 0.7700.

The AUD/USD is rising today ahead of Australia’s December employment numbers and because of the overall weaker US dollar and higher commodity prices. It is trading at 0.7718, which is slightly higher than this week’s low of 0.7660.

Strong Commodity Prices

The Australian dollar is often viewed as a proxy for commodity prices because of the vast amount of resources with which the country is endowed. This week, most commodities have continued rallying even as risks of an economic slowdown due to the pandemic rise. The price of copper, iron ore, gold and crude oil have continued to rise.

This strength is also partly because of the strength of the Chinese economy. On Monday, data from China showed that the economy increased by 2.3% in 2020 and by 6.5% in the fourth quarter alone. That provided more evidence of further demand for the commodities.

The commodities price action is also partly because of the weaker US dollar. The US Dollar Index has dropped for the past three consecutive days, erasing some of the gains made last week. The currency has weakened because of the potential for a bigger stimulus package in the Biden administration.

Australia Jobs Data Ahead

The AUD/USD is holding steady ahead of the December Australian jobs data that will come out tomorrow. Economists expect the country’s economy did well in December. They see the economy adding more than 50,000 jobs, which will be lower than the previous month’s addition of 90,000.

Economists also see the unemployment rate falling to 6.8% and the participation rate rising from 66.1% to 66.2%. Strong Australian numbers will be bullish for the AUD/USD because it will rule out the potential for negative rates by the RBA.

AUD/USD Technical Outlook

The hourly chart shows that the AUD/USD pair found strong support at 0.7665 level this week. It has formed a small ascending channel and is slightly above the 15-period and 25-period EMA. It is also slightly below the 23.6% Fibonacci retracement level.

Therefore, the pair will likely rise and reach the upper side of the channel at 0.7730. It will then pullback as bears target the lower side of the channel that is also along the 38.2% retracement level. Also, due to be bearish flag, the pair will likely end the week lower.