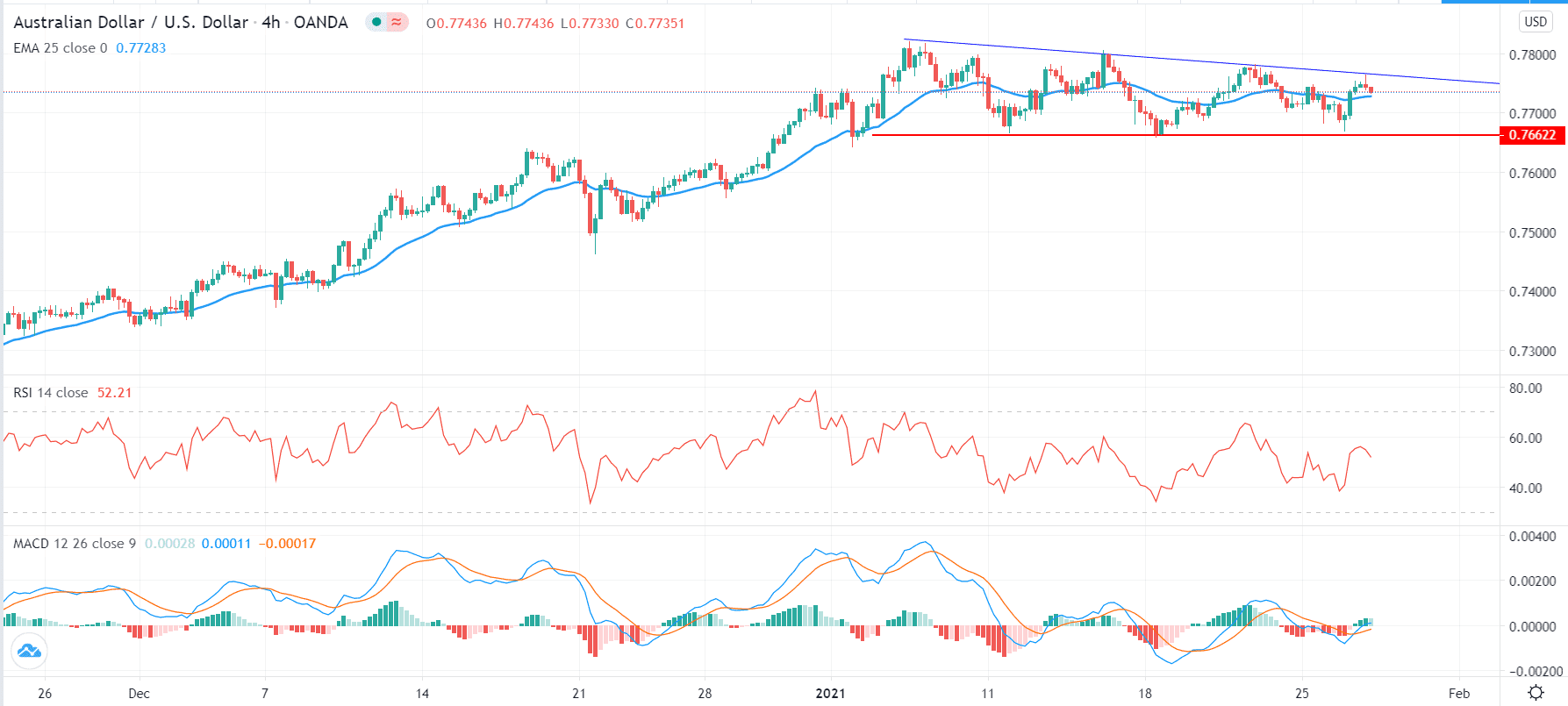

Bearish case

Set a sell stop at 0.7700, which is an important psychological level.

Add a take-profit at 0.7670, which is the lower side of the channel.

Set a stop-loss at 0.7780 (slightly above the resistance)

Bullish case

Set a buy stop at 0.7780 to take advantage of a bullish breakout.

Add a take-profit at 0.7850 and a stop-loss at 0.7700.

The AUD/USD wavered during the Asian session even after the relative strong economic data from China and Australia. It is trading at 0.7738, which is slightly below yesterday’s high of 0.7765.

Australia Inflation Rose in Q4

The Australian consumer prices rose faster than expected in the fourth quarter. According to the Australian Bureau of Statistics, consumer prices rose by 0.9% in the fourth quarter helped by tobacco, higher oil prices, and end of the free childcare program. This was a faster increase than the median estimate of 0.7%.

The prices rose by 0.9% on an annualised basis. This performance is still below the 2% target by the Reserve Bank of Australia. Similarly, the trimmed mean and weighted mean CPIs increased by an annualised rate of 1.2% and 1.4%, respectively.

Further data showed that business confidence declined from 12 to 4 while the business survey increased from 9 to 14.

The AUD/USD is also reacting to the strong economic numbers from China; Australia’s biggest trading partner. The data showed that the country’s industrial sector continued to fire on all cylinders in December.

In total, profits increased by an annualised rate of 20.10% in December after rising by 15.50% a month before. From January to December, profits increased by 4.1% amid the pandemic. Economists believe that this trend will continue this year helped by robust international demand for China’s products.

The next big mover for the AUD/USD price will be the Fed interest rate decision and the important durable goods numbers from the US. Based on its previous guidance, the Fed will leave its pandemic response tools like interest rates and quantitative easing policies unchanged. Still, the language during Jerome Powell’s testimony and the dot plot will have an impact on the AUD/USD pair.

AUD/USD Technical Outlook

The AUD/USD has formed a channel pattern on the four-hour chart. At the current price, it is a few pips below the upper side of this channel. Also, it is a few pips above the 25-period exponential moving average. Oscillators like the Relative Strength Index (RSI) and the MACD are also at their neutral levels. It has also formed a small shooting star pattern.

Therefore, in the near term, the pair will likely drop as bears target the lower side of the channel at 0.7662. However, a bounce above the upper line of the channel at 0.7765 will invalidate this prediction.