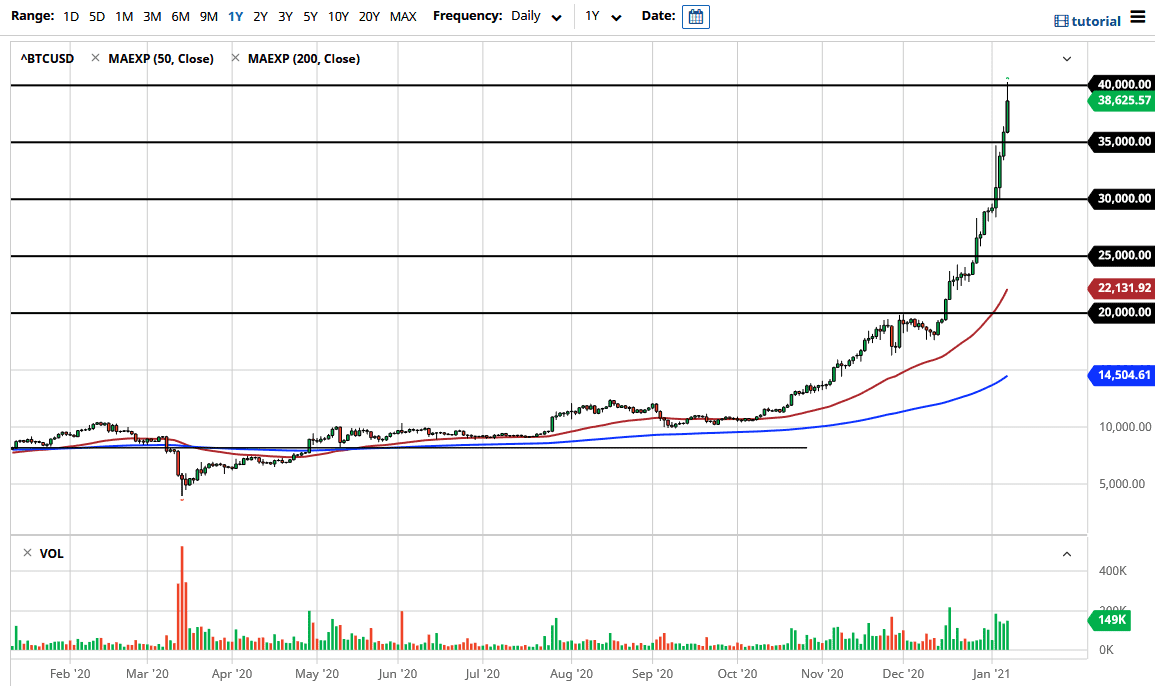

The Bitcoin market has rallied again during the trading session on Thursday, reaching the milestone of hitting $40,000. That being said, I am still very concerned about a lot of retail traders that I see piling into the Bitcoin market. While I do believe that this market probably goes higher, the biggest issue you have is that for any reason whatsoever if we start to see selling, it could cause a cascade or waterfall effect of massive selling. The overall trajectory has simply been far too steep, and this cannot go on forever. Let us put it this way: if we were to get a simple 50% retracement of this most recent move, we are looking at a pullback of at least $10,000.

Obviously, a lot of this comes down to your position size but buying at this extreme high price is very risky to say the least, and clearly the real money was made on the breakout from the $20,000 level, or even better yet when we bounce from the $10,000 level. Most people will not have gotten into the market back then, and unfortunately you see a lot of “dumb money” rushing into the market when it is far too late. Again, this is not an argument to start shorting Bitcoin, but rather me warning you to wait for some type of inevitable pullback.

As for myself, I am willing to buy deep out of the money pots, because if this gets any type of pullback like we have seen before in the market, that could be a great way to play this market. It is obviously a trade, and more importantly one that limits overall risk, but where and when I do that is still up for debate. I do not feel particularly rushed to start shorting this market, just as a do not feel the need to jump in and try to ride whatever is left in the tank when it comes to this spike.

I have every $5000 marked on the chart, because that is about the only way you can do analysis on a runaway market. Eventually, something will happen to make this market shutter, and we will probably see a sudden and very large red candlestick. When that day comes, enough selling pressure could have a lot of people running for the doors in one shot. However, I think that is exactly what you want to see if you are not already involved here.