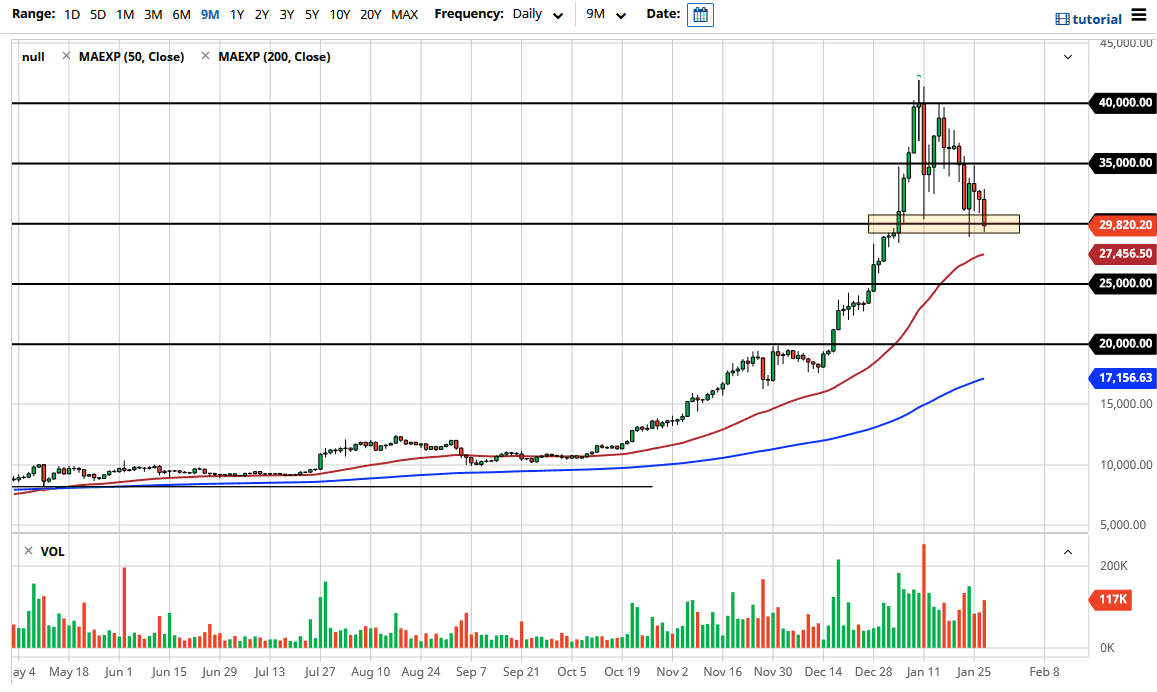

The Bitcoin market initially tried to rally during the trading session on Wednesday but then turned around to sell off quite drastically. At this point, the market is likely to continue to look at the $30,000 region as rather crucial. Furthermore, I think that it is more or less a “zone” of support at this point and therefore I would look at this more or less as a particular range to pay attention to. If we were to break down below the lows of last week though, somewhere near the $29,000 level, then I think Bitcoin is in serious trouble, at least for the short term.

Keep in mind that the market had shot straight up in the air for several months, and of course we had gained 40% in the month of December alone. Those types of gains of course are not sustainable, and now the question is whether or not we will see buyers on that dip? I do think that is the case, but where that happens is a completely open question at this point, because you can notice easily by looking at the chart that every time the market falls towards this support level, it bounces just a little less. That is typically a sign that we are going to see the market break lower, not higher.

If we do have that breakdown, the first support level would be the 50 day EMA which is closer to the 27,600 level. After that, then we have the 25,000 level which of course is a large, round, psychologically significant figure, and then after that we have the 20,000 level which I believe is much more substantial than the other two. I do not know that we get down to that level anytime soon, but if we did, I suspect that there would be a lot of interest at that point.

On the other hand, we could turn around before breaking down and that would be signified by a significant break to the upside that clears the $35,000 level. At this point, it does not look very possible in the short term, but obviously we have to take all potential moves into the thought process when it comes to Bitcoin as it is so erratic at times. One thing is for sure, there has been a lot of air let out of the bubble which at the end of the day is a good thing.