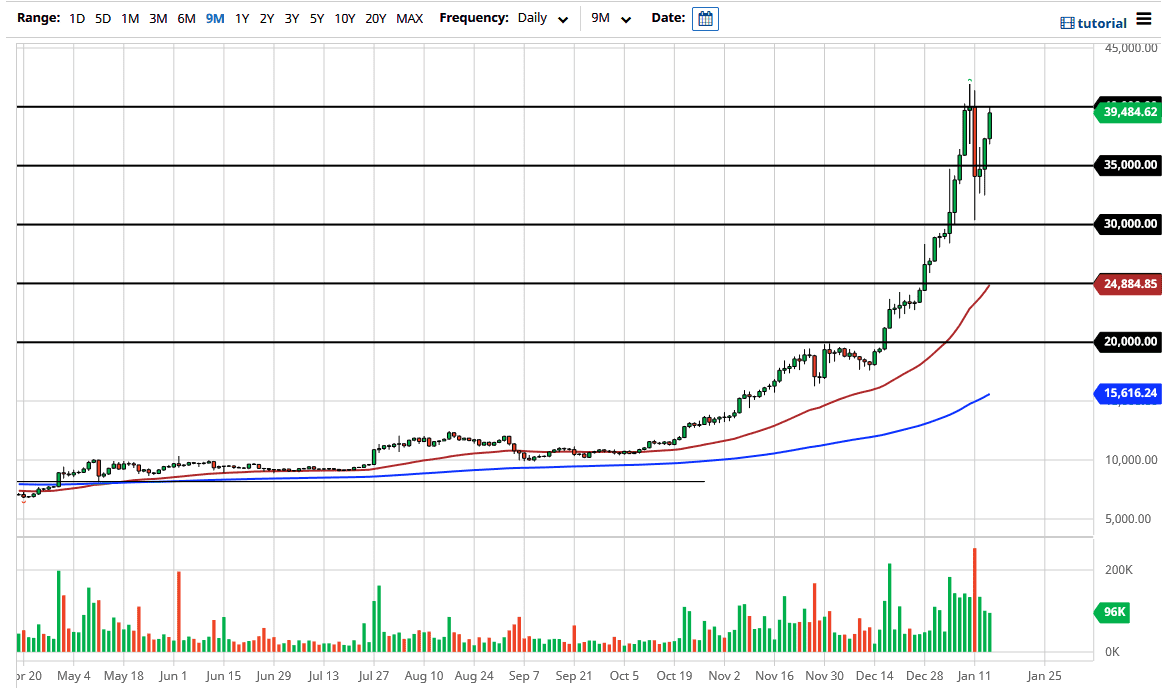

The Bitcoin markets have rallied again during the trading session on Thursday to reach towards the $40,000 level again. This is interesting, considering that we had a flash crash of over 20% one day, when sideways the next, and have rallied again towards the highs the next two. This is not necessarily healthy behavior, but I would not be a seller of Bitcoin at this point. The only way to trying to bet on the price of Bitcoin going lower is options, because when the markets get a bit erratic and parabolic, they can continue to run much higher and quicker than you anticipate. This of course has been seen over the last couple of months.

That being said, it is a small market and the volume really is that there half the time. That could be one of the culprits to what is going on, as a handful of institutions have actually stepped in and started buying. There is also a certain amount of people willing to jump in and try to front run the institutions, which of course is rather bullish. However, the biggest problem that we will see here in this market is that eventually gravity comes back. It is because of this that I am very concerned about going long at this point, but I also recognize you certainly cannot sell it. If we make a fresh, new high then it is possible that we have another leg higher, perhaps trying to get to the $50,000 level. It is normal market, that would be somewhat outrageous to suggest, but we have seen stranger things in this market than many others.

On signs of weakness, you could have people flushing their holdings to reach down towards the $35,000 level, and unfortunately that could literally be within a blink of an eye. At this point, the only way you should be buying Bitcoin is if you plan on hanging onto it for the long haul. The biggest problem with the next leg higher is that it will cause even more instability, and what is an already unstable environment. Momentum is a funny thing; it runs until it does not. Once it stops, everybody could run towards the exits at the same time like we had seen on Monday. Caution is definitely important, and probably the most important thing that you can hold yourself to. The market still needs a bit more of a correction to be sustainable for the longer term.