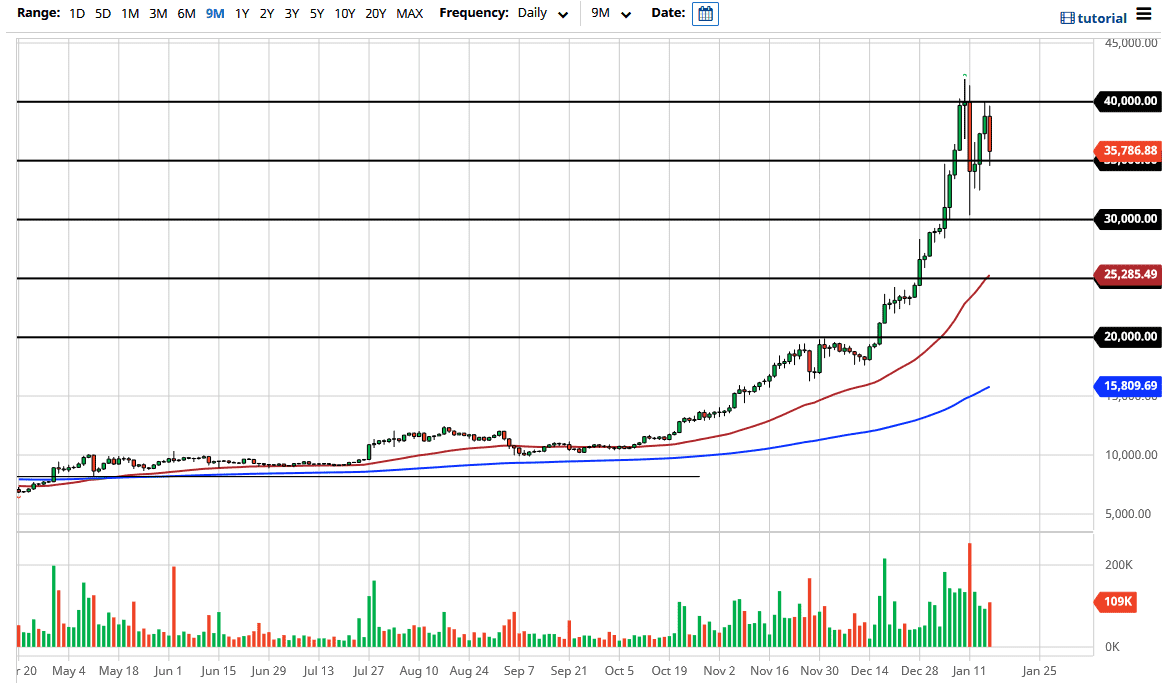

Bitcoin markets initially tried to break above the $40,000 level during the trading session on Friday but gave back the gains to break down significantly and reach towards the $35,000 level. That is an area that has been supportive more than once, as well as resistive. The Bitcoin markets had gotten far ahead of themselves and now I think we are trying to sort out whether or not we can hang on to these massive gains. After all, parabolic markets very rarely end well, and most certainly this is not a big enough market to handle massive influx of orders without seeing some type of major reaction.

If we break down below the bottom of the candlestick for the trading session, then it is likely we go looking towards the $30,000 level underneath. The bottom of the candlestick that was the massive breakdown candlestick is at that $30,000 level as well. That level is a large, round, psychologically significant figure, so it makes quite a bit of sense that we would have a reaction in that general vicinity. If we break down below the $30,000 level, it is likely that the market will go looking towards the 50 day EMA underneath, especially as it is close to the $25,000 level.

That being said, I think that we are probably going to see more back-and-forth reactions than anything else, especially as we go through the weekend. The $40,000 level is obviously a major resistance barrier, and I think that the market is simply trying to get used to being up here. However, the US dollar continues to strengthen the way it has over the last couple of days, it is only a matter of time before that weighs upon Bitcoin. While I know a lot of Bitcoin traders look at fiat currencies as being completely detached from Bitcoin, the reality is that it is priced in US dollars. If the US dollar strengthens, that typically will put downward pressure on Bitcoin, although it does not have to be a one to one correlation. At this point, I would be very cautious, as I believe the volatility is going to get worse in the short term, not any better at this point. This candlestick for the trading session on Friday shows that we at the very least will probably try to reassert whether or not that support from a couple of days ago continues.