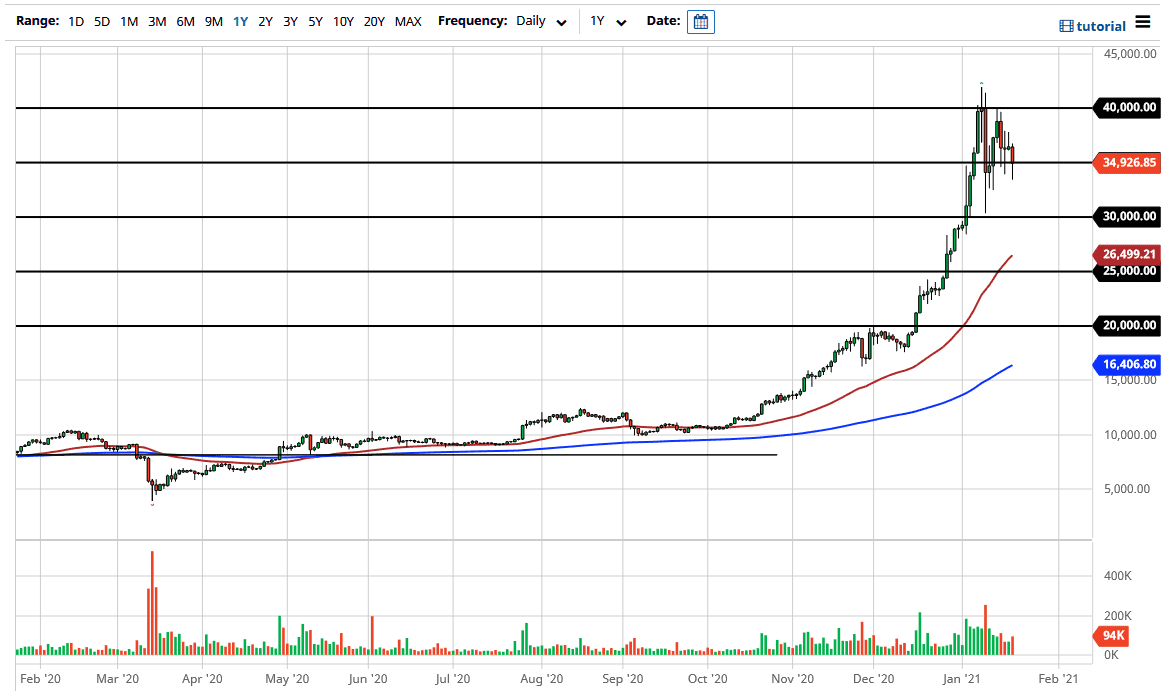

Bitcoin fell rather significantly during the course of the trading session on Wednesday, breaking below the $35,000 level before turning around and showing signs of life again. That being the case, we have formed a candlestick that is somewhat like a hammer. This suggests that the market will continue to have buyers on dips, but clearly at this point we are starting to see “cracks in the ice” when it comes to the bullishness. The volatility is quite common in a market that has been overbought the way that this market has been.

Furthermore, Bitcoin has done this before, racing straight up in the air before breaking back down. The question at this point is whether or not we can continue the upward trajectory? I do believe that we can, but at this point in time we need to at the very least grind sideways in order to build up enough momentum to go higher. Pulling back the way we have suggests that there are plenty of buyers underneath, but quite frankly the question is whether or not we get some type of major breakdown first?

The 50 day EMA is sitting at the $26,496 level, and I think that could be a good place to pull back to in order to find a technical reason to go long. At this point, I think that a lot of people would be looking at this as a market that is forming a symmetrical triangle, which of course suggests that we could go in either direction. I would assume that a lot of people would be cautious about buying Bitcoin at these extreme levels, so I think a pullback makes more sense than to simply take off to the upside. However, in all candor I can say that was an argument that people have had at multiple levels underneath as well. Bitcoin is such a small market that we have simply shot straight up in the air. However, you need to be very cautious about jumping in with a full position size, because you could get really hurt doing just that. I do not have any interest in shorting this market, although you can make an argument for buying puts if you get signs that we are breaking down. Regardless, I think we have some time to kill before we can break out to the upside.