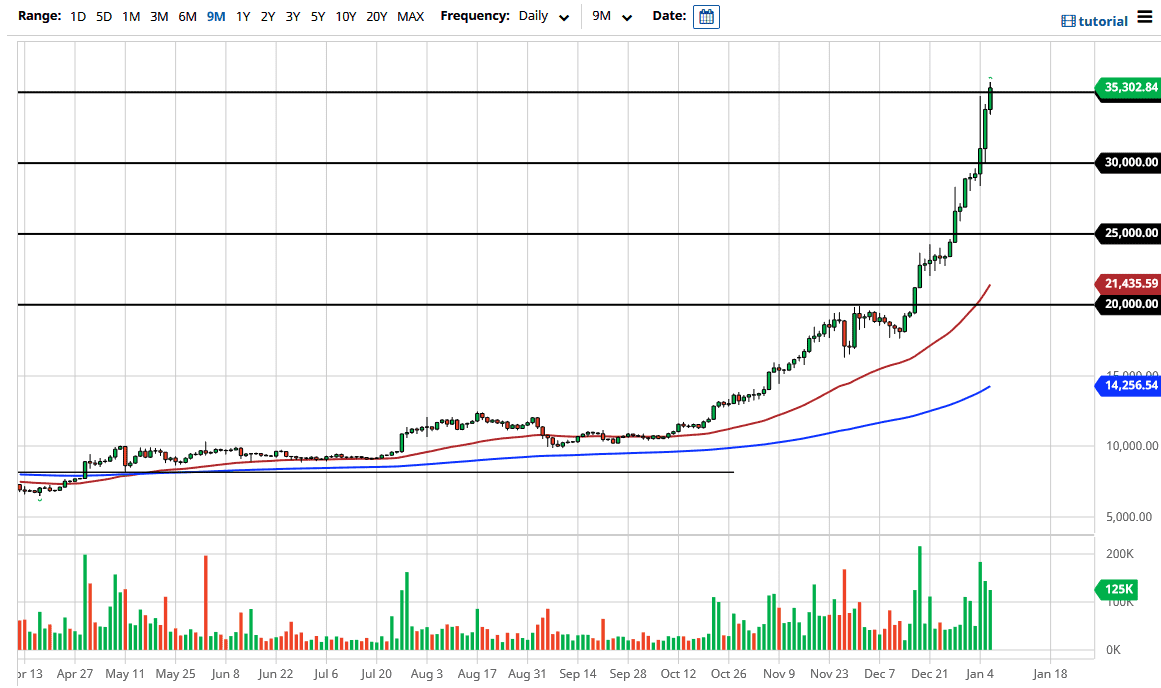

The Bitcoin market broke above the $35,000 level during the trading session on Wednesday, as we continue to see concerns about stimulus now that the Senate has "flipped blue”. This means that the Democrats have run a clean sweep of the US government, opening up the possibility of even more stimulus and spending in the United States, thereby driving down the value of the US dollar. The size of the candlestick suggests that we may see a bit more continuation, but at this point, it does not take much imagination to see that this market has gone beyond parabolic.

I would not be a seller of Bitcoin anytime soon, because this market has a history of being irrational. If you are buying Bitcoin after a move like this, you are assuming that the move is going to continue in perpetuity. Do not get me wrong; I think it will probably go higher eventually, but sooner or later we are going to get a correction. When you see a move like this, a correction can be very nasty indeed. I can make a very serious argument for a $10,000 pullback. Think about that for a moment: A $10,000 pullback. That is no joke for the average retail trader if you have any size at all in the trade.

However, if you are thinking long term, then that move will be an opportunity to pick up more Bitcoin. I do not know what the future holds, but I do know that eventually gravity will come back into play. The only reason Bitcoin can behave like this is that the market is not that big. You see moves like this with things like iron ore futures, aluminum futures, and the like, that only trade on smaller exchanges. It does not matter whether or not you believe in the future of Bitcoin; this is a dangerous chart and sooner or later the pullback will be inevitable. I would not be a buyer after this type of move, and at the very least I would be waiting for an opportunity at much lower levels. Sometimes, if you have missed the move, you have simply missed the move and it is time to move on. One lesson here is that you can make money in any market, just as you can lose it. The problem with this market is that widespread adoption is an assumed thing, but has not been a reality yet. In other words, it is not being used as a currency; it is being used as a speculative instrument. This is not a bad thing necessarily, but something that people fail to take into account.