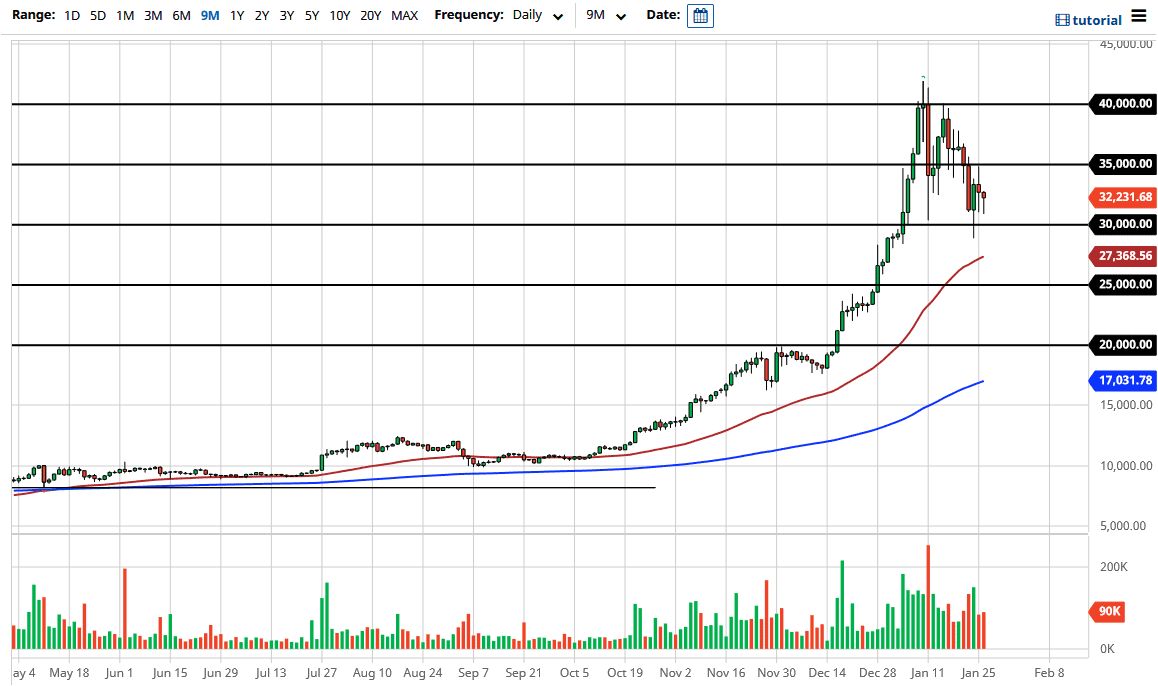

Bitcoin markets fell initially during the trading session on Tuesday but continue to find buyers just above the $30,000 level. This looks like a descending triangle, and we are getting close to making some type of decision. I suspect that by the end of the day on Wednesday, we may have a bit more in the way of momentum, simply because we have the Federal Open Market Committee meeting and press conference in the afternoon. If Jerome Powell suggests that they are going to continue to do everything they can to eviscerate the US dollar, that will more than likely be what Bitcoin needs to boost a bit higher.

However, if it is a relatively ho-hum affair, a break down below the $30,000 level could open up a significant pullback. From a structural standpoint, I still maintain that this market must, at the very least, work off the froth that it has recently seen. We have done quite a bit of that, but whether or not we have done enough is the trickier part of the question. I obviously would not be selling Bitcoin at this point, but I need to see some type of momentum into the market again in order to get long or add to a position. I have made a few trades in Bitcoin using the CFD market, all from the short side over the last couple of weeks. None of these have been huge, they are just a simple “reversion to the mean” type of scenario.

Bitcoin faces a lot of questions, not the least of which will be its actual end game use. One of the biggest problems with Bitcoin going forward is the narrative seems to change every once in a while. I have seen it go back and forth between being “digital gold”, and a “superior payment system.” Furthermore, I have seen it being used as a “way to hedge currency devaluation”, and then perhaps simply just a bubble. At this point, Bitcoin is still trying to figure out exactly what it is. One thing it certainly will not be is a currency, as long as it is as unstable as it is in its current form. Nonetheless, we are starting to see institutions talk about getting involved, but they will not “pay up” for an asset; that is not what professionals typically do.