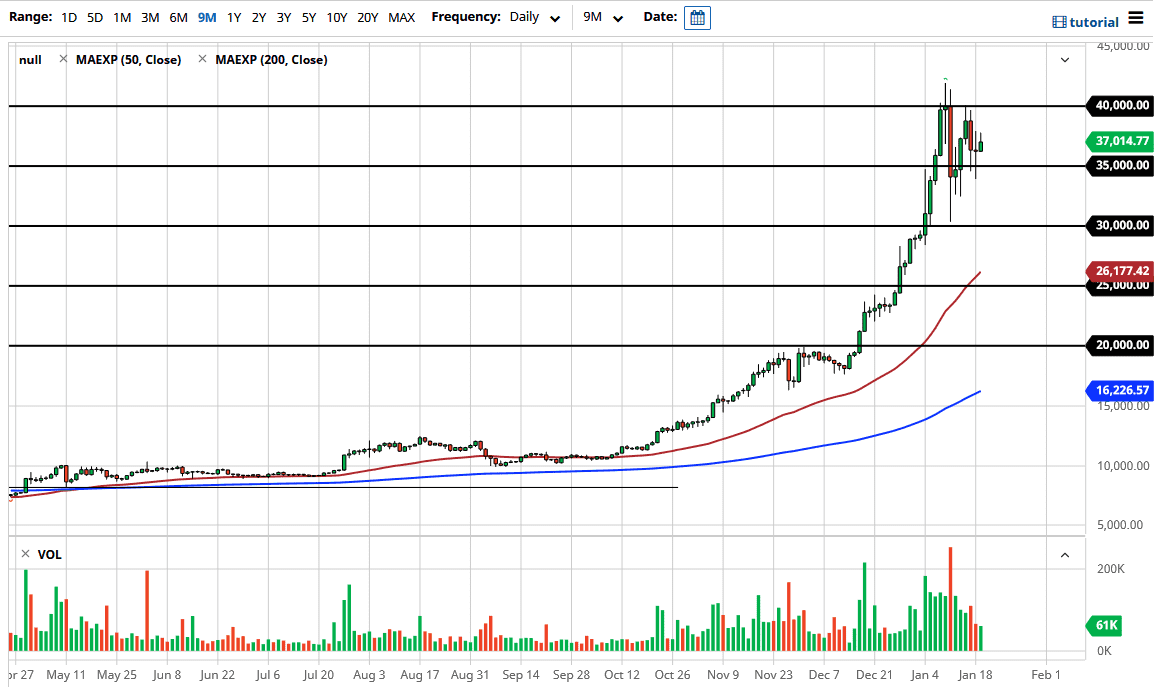

Bitcoin markets initially tried to rally during the trading session on Tuesday but have struggled to hang on to gains. When you look at the chart, you can see that it is forming a bit of a triangle, and it looks like we are trying to build up enough momentum to go in one direction or the other. What I find rather interesting at the moment is that the market is killing time and building a certain amount of consolidation in this area, but not leaning in one direction or the other. This still gives roughly 50% chance of moving in either direction.

To the downside, if we break down below the bottom of the candlestick from the Monday session, then I think it opens up a move down towards the $30,000 handle. On the other hand, if we can break above both the Monday and Tuesday candlesticks, we could go looking towards the $40,000 level. This is a market that will probably be very noisy to say the least, because we were so far ahead of ourselves that something like this was necessary. Furthermore, you cannot say that the Bitcoin market is completely out of the woods in the short term, because a sharp correction could turn things right back around.

It is very likely that the market still needs to pull back a bit, and pulling back significantly could be a nice buying opportunity for those who believe that this is a long-term uptrend ready to continue. I think this is more than likely to be the case. In fact, I would be very cautious about selling until we slice through the $30,000 level. We may continue to see more of a “buy on the dips” type of mentality. To the upside, if we do break above the $40,000 level, then it is likely that we could go looking towards the $50,000 level given enough time. The market has gotten a bit parabolic, so this sideways action should continue to be looked at with favor, as it is something that will be necessary.