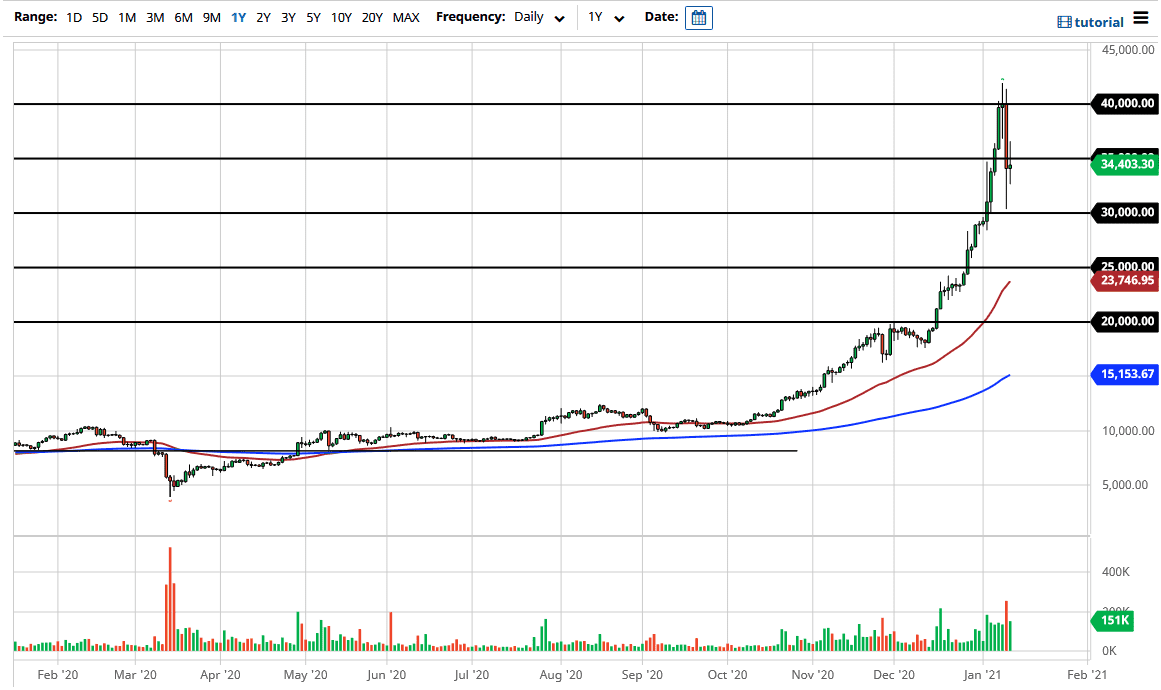

Bitcoin fluctuated during the session on Tuesday as we continue to dance around the $35,000 level. The cryptocurrency has been very volatile and very dangerous, regardless of how bullish it has been, and the massive selloff that we saw was going to happen sooner or later. A 20% drop at one point was what we had seen on Monday, and things like that typically do not happen in a vacuum. This is not to say that we should be sellers of Bitcoin, rather that a correction is desperately needed, and it is very likely that we should continue to see a bit of a pullback because the market had gotten way ahead of itself.

The $30,000 level underneath is a large, round, psychologically significant figure, and an area in which buyers have been involved, as we bounce directly from there during the Monday session. The 50-day EMA currently sits at the $23,742 level, reaching towards the $25,000 level. This has happened before in the Bitcoin market, although I do not think that this time it will be as bad as it was a few years ago. There are institutions getting involved in the market now, which should continue to offer a bit of bullish pressure over the long term. However, not all are institutions, and the number of institutions involved are somewhat small, but it is much larger amounts of money flowing into the market than per usual.

To the upside, the $40,000 level has offered significant resistance, but at this point, the market will probably look at that level as a potential target, perhaps even an opportunity to break out above there. However, we need to correct even further, because you have a market that had gained 40% during the month of December alone. These are not normal returns, not even for Bitcoin. Buying the dips continues to be the best way forward, but we do not have the signal yet. I would be on the sidelines, waiting to see a supportive candlestick underneath to get involved. In other words, if you are patient enough you should have a nice opportunity, but right now we just do not have it.