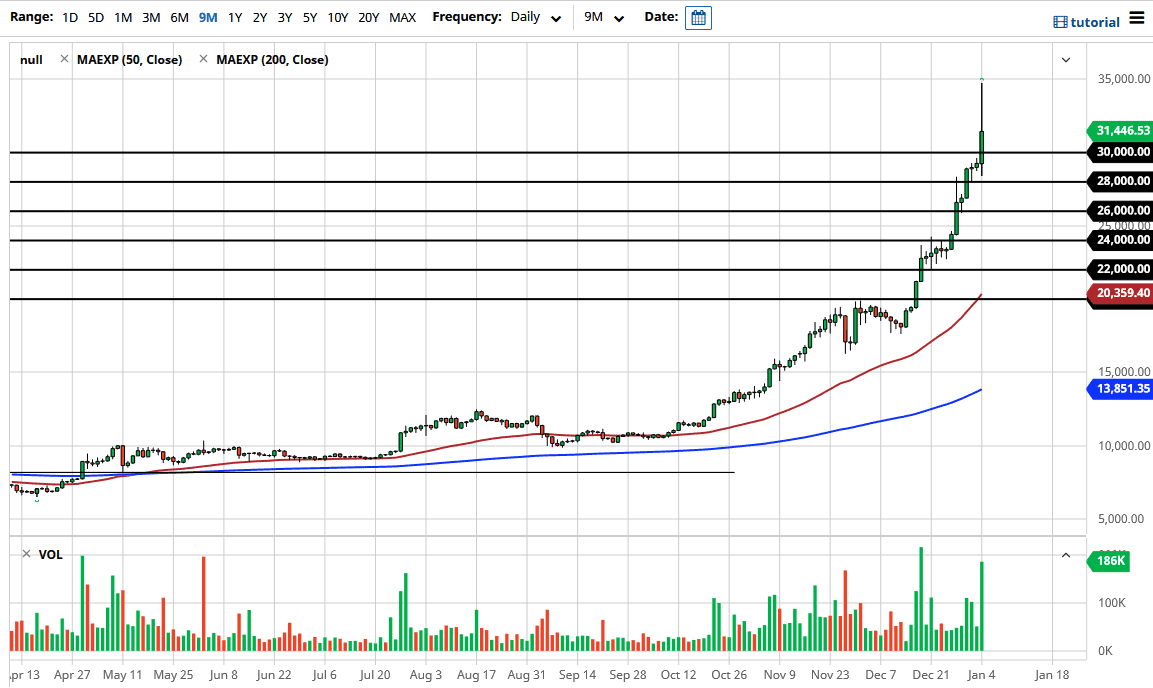

The Bitcoin markets initially pulled back during the trading session on Monday, but then found massive amounts of volume to the upside during the day to reach as high as $34,800 at the peak. From there, the market then fell rather hard, only to find buyers again. This is the very essence of how Bitcoin tends to trade: extraordinarily volatile moves like this.

This looks a whole lot like the last time we had a major blow up in this market. I am not ready to start calling for that yet, but things are definitely getting very dangerous at this point. While there was a lot of volume, the thing that concerns me is that so much of the gains had been given up, and everybody in the world is talking about Bitcoin again. That is almost always a bad sign, especially when it comes to Bitcoin for some reason.

I have had conversations with several traders over the last couple of weeks, and I tried to explain to them how a 40% gain in one month is not typical. It is always interesting to me how many people will gloss over that fact. It very well could go higher down the road, and I think there is an argument to be made for that. However, what most people do not pay attention to is that if we do have a major correction, that could be all the way down to the $20,000 level. At the very least, you are probably looking at a move down to $24,000. Very few traders can take that type of drawdown and feel remotely comfortable. It really comes down to your conviction. The problem with Bitcoin is you have to assume that all of your trading capital is gone in order to realize the true gains. You have to be literally willing to walk away and accept that this whole thing could go to zero. I do not think it will, but with this type of volatility, that is essentially how you have to treat it. A significant pullback is coming, and the more of this nonsense that we have seen on Monday occurs, the more violent it will be.