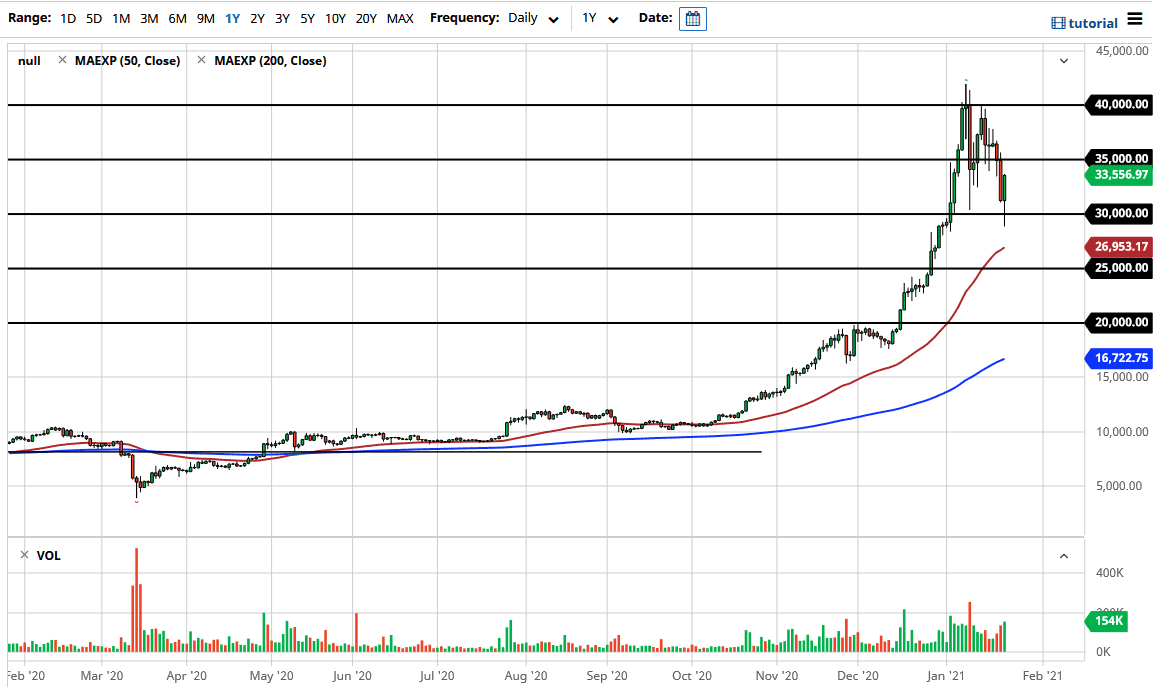

The Bitcoin market broke down below the $30,000 level on Friday but turned around quite nicely to show signs of support. This suggests that perhaps buyers are trying to take a stand in this general vicinity. However, it is worth noting that this is a market that can be very volatile, and therefore it will be interesting to see if $30,000 can hold for the longer term.

If you have been following my analysis here at Daily Forex, you know that I suggested that the $30,000 level was going to be crucial. I also suggested that if we break down below that we could fall apart. However, the fact that we have closed above it shows that it has in fact been defended. This is a market that is forming a descending triangle, which could measure for a move down to the $20,000 level. Now that we have defended this market the way we have during the day on Friday, it suggests that we could very well go looking towards higher levels, but it also opens up the possibility of a move below the bottom of the hammer.

If we were to break down below the bottom of the hammer, that opens up the possibility of a move down to the $20,000 level. The market can go either way at this point and, at the very least, we need to calm things down before buying. Unfortunately, if we break above the top of the candlestick and look like we are going to go higher, I see a lot of physical resistance closer to the $35,000 level, extending to at least the $37,000 level. The market had gotten way ahead of itself, so this correction was definitely needed. Unfortunately, we have not spent enough time grinding sideways to make this look like a market that has stabilized enough to bring in fresh money. Beyond that, Janet Yellen suggesting that she is going to make things difficult for institutional investing is a major blow to the market. Beyond that, there is also the suggestion from her that they may start to tax unrealized capital gains. If that is the case, it would wipe out a lot of investing in various assets, not just crypto. In the short term, though, I suspect that short-term pullbacks should be buying opportunities, but you need to look at this more or less as a short-term market. If we break down below that candlestick from Friday, then it is time to simply sit on the sidelines and wait for better buying opportunities.