Bitcoin markets have been all over the place during the trading session on Monday as it looks like we are looking to find direction. Right now, it is very unlikely that we will see an easy move, but one thing that is worth paying attention to is the fact that the market fluctuated violently during the trading session on Monday. We have been very bullish for quite some time, so to take a little bit of a break is not a huge surprise at this point.

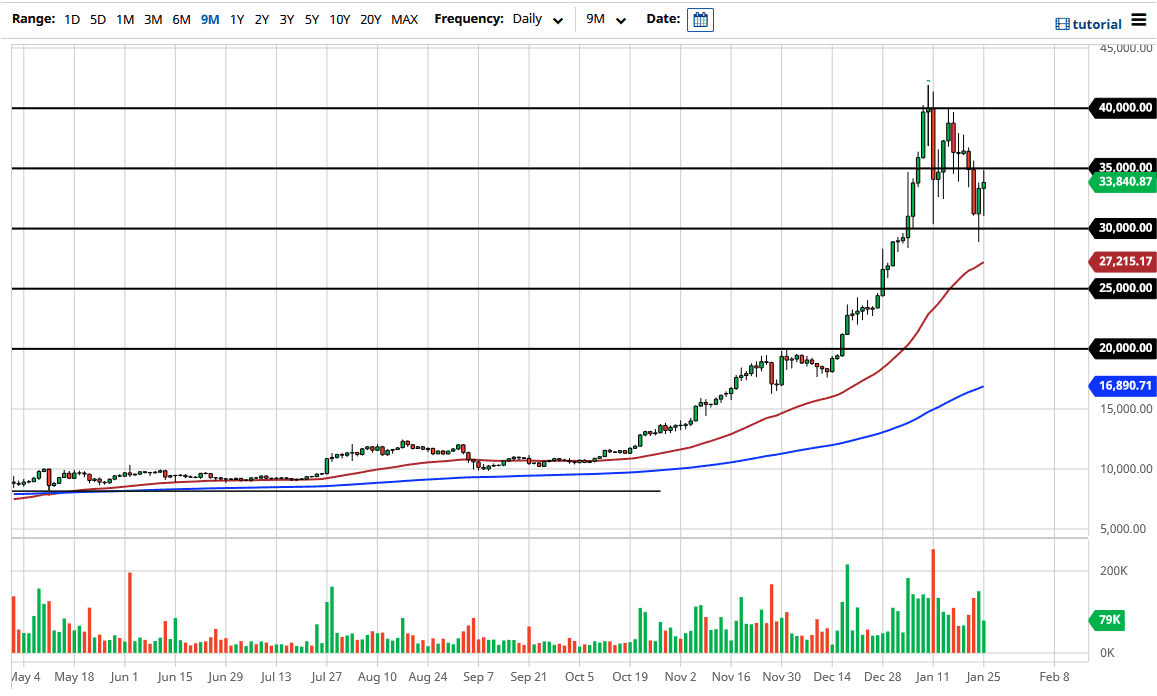

Looking at the $30,000 level underneath, I would anticipate that there should be a certain amount of support, if for no other reason than the fact that it is a large, round, psychologically significant figure. We had seen the market bounce from there previously, so it does make sense that there is a bit of “market memory” there as well. The 50-day EMA sits at the $27,200 level and is rising towards the area where we sit. If we were to break above the $35,000 level, that could be a very bullish sign, but there is a lot of noise above there, and there has been a lot of choppiness above there as well, so I think that a breakout will not necessarily be easy and would probably need help in the form of the US dollar getting hammered.

The market got far ahead of itself, so it is going to be difficult to imagine a scenario in which we can simply rip to the upside without at least killing some time in this general vicinity. On the other hand, if we were to break down below the 50-day EMA, that could lead to more selling pressure, as the market had gotten to be a bit of a bubble. At that point, we could go looking towards the $20,000 level underneath, where I would see a significant amount of support. The $20,000 level is a large, round, psychologically significant figure, and the scene of a major breakout previously. One thing you can count on is that it is going to be very noisy, but right now it is a bit rich, so I would be cautious about piling into it here. If you are looking to get involved longer term, then do so slowly.