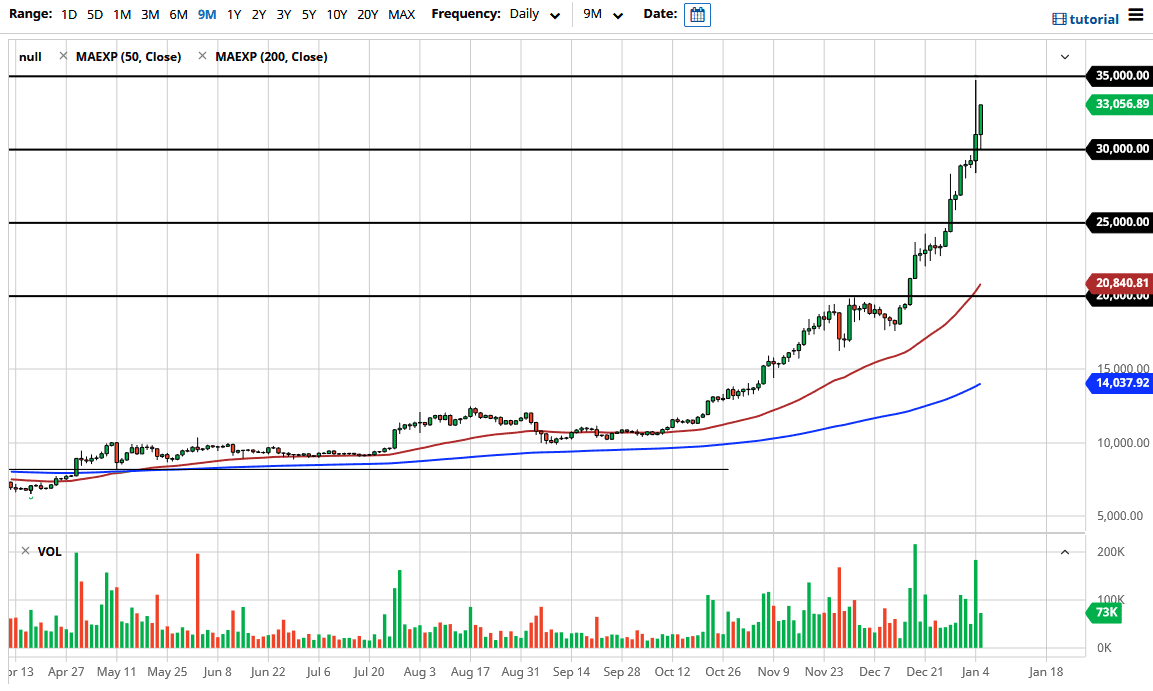

The Bitcoin market initially fell during the trading session on Tuesday but found the $30,000 level to be supportive, then shot up over the $35K level. The market gained 40% during the month of December, which even by typical Bitcoin standards is ridiculous. There is a significant amount of institutional money flowing into the market, which could drive prices higher.

It is very difficult to continue this type of momentum, and the biggest trick here is to determine when it is time to get out. One of the biggest questions to ask at this point is “What happens if it pulls back at this point?” Unfortunately, that pullback could last several months, if not a couple of years if it gets serious enough. We have already seen this in Bitcoin, but I am not necessarily saying that we are going to have the type of breakdown that we had a few years ago. However, gravity eventually comes back into the markets, and if you look at just the last couple of weeks, retracing half of the move would be somewhere around $7500 or so. In other words, the pullback is going to be brutal if and when it finally happens. It is because of that reason that you should be looking for a pullback in order to get involved.

Breaking above the $35,000 level is a signal that we will continue to go higher, but things are getting so out of control at this point that I fear this simply will not end well. We should get a nice opportunity to get long of Bitcoin on a massive selloff. The $20,000 would be an excellent entry point, and I do believe that we will get back down there eventually. However, you clearly cannot be a seller. If you are already long of this market, then you are fine; but if you are not, you are basically planning on holding on to this forever, because you could see a massive pullback that takes ages to recover from, or it can simply go straight up in the air. Technical analysis and common sense have both left the building.