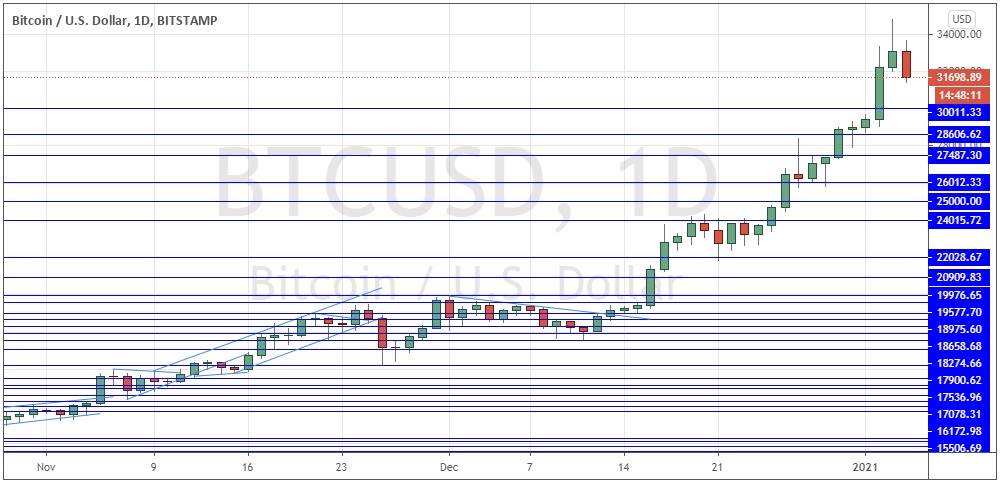

Bitcoin markets fluctuated during the trading session on Thursday, but then rocketed to the $34,800 level yesterday. The $30,000 level below should offer significant support, if for no other reason than the fact that it is a large, round, psychologically significant figure.

The $28,000 level has offered a bit of support, so if we were to break down below there we could continue to go lower. We are so overdone right now that it is not even funny, and all one has to do is listen to people in forums or YouTube as to how “Bitcoin is going straight to the moon”, which is a sure sign that we are in a bubble. That does not necessarily mean that it is going to be a long-term bubble, but we are getting so overdone that we need to pull back significantly. In fact, I would love to see a pullback towards $20,000 before buyers get involved, because not only is a large, round, psychologically significant figure, but it is also from where we had broken out. This major breakout has not been retested, so I still think that is necessary. Furthermore, the 50-day EMA is sitting just below it, so that is yet another reason why we could find technical support.

On the other hand, having broken above the $30,000 level, it is anybody’s guess as to when gravity comes back into play. Some significant pullback is probably needed in order to build up the necessary value to put serious money back to work, and I am a bit concerned at how many retail traders may end up getting hammered buying at this extraordinarily parabolic level. Nonetheless, I think that we will get a major shakeout, and that should offer a nice buying opportunity. Clearly, this is not a market that you can short, due to the fact that it such a bullish market in general. Furthermore, the stimulus and quantitative easing that we are seeing around the world should continue to lift alternative assets such as this one.