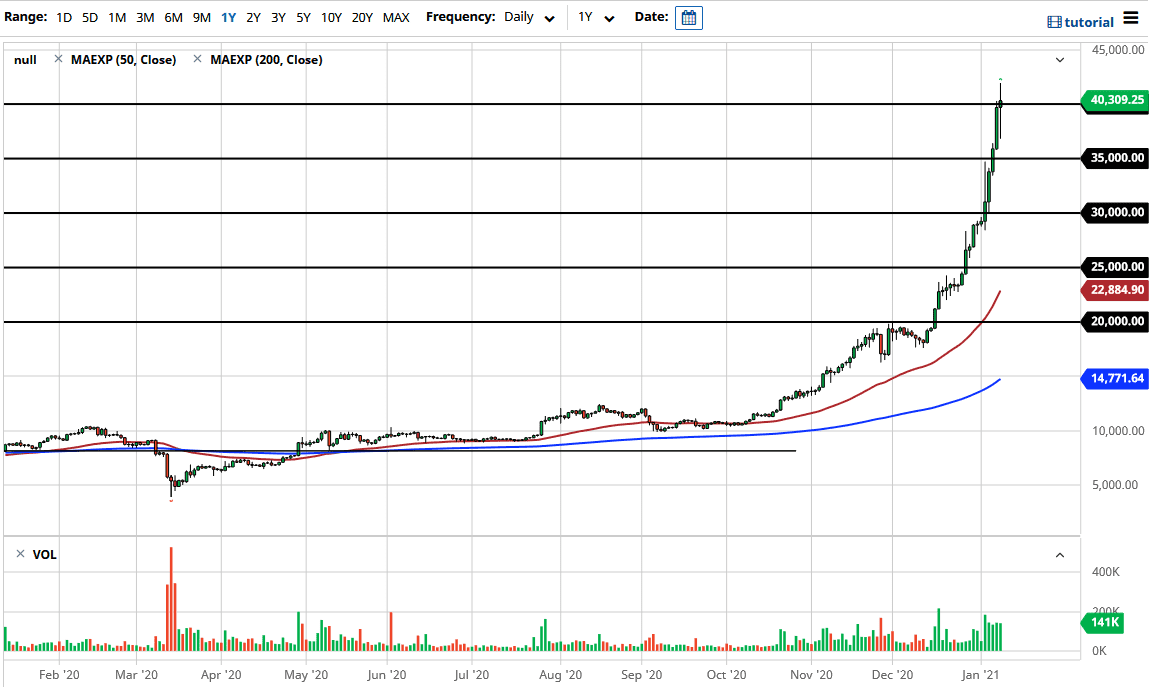

Bitcoin markets had a wild ride during the trading session on Friday again, as we try to figure out what to do with the $40,000 range. The market is over-extended, and this is the first sign of the market running out of momentum in quite some time. The candlestick that we have formed suggests that we are going to have a pullback finally, something that has desperately been needed for a while. This is a market that is obviously very bullish, but given enough time, you need to see a significant sell-off in order to find value again. Essentially, sooner or later we will see gravity come back into play.

The market went as low as $37,000 during the trading session, but also saw Bitcoin rally all the way to $42,000. In other words, we have been all over the place. This is a market that is still very bullish, but the market pulling back the way it has suggests that we are starting to see some “cracks in the ice” when it comes to the uptrend. Do not get me wrong, I am not looking for a major trend reversal; but I expect a rather significant pullback due to the fact that the market has been going parabolic. Parabolic markets NEVER end well. This market continues to be flooded with institutional money, and that is part of the reason that we are seeing this parabolic move, because the Bitcoin market is very small.

To the downside, we could very easily drop to the $30,000 level, possibly even in a single day. We have seen this type of action before in this market, but you also see this type of action in several other markets in the past as well. This is not to say that we cannot go higher in the short term, but sooner or later we will have a certain amount of “reality and gravity” coming back into the picture. If we can get a significant pullback, it could offer enough value for people to get involved. At this point though, most people buying Bitcoin are investing in the “greater fool theory.”