Bullish ideas

Buy BTC/USD due to the strong momentum.

Have a take-profit at $40,000.

Add a stop loss at the psychological important at $35,000.

Bearish ideas

Short BTC/USD if it falls back to $35,000.

Add a take profit at $33,000.

Put a stop loss at $37,000.

The BTC/USD is in an unstoppable rally. Bitcoin price soared to above $37,500 in overnight trading, meaning that it has risen by more than 370% in the past 12 months alone. Other altcoins like Ethereum, Litecoin, and Chainlink also rose, pushing the total market cap of cryptocurrencies to more than $1 trillion.

More Stimulus Hopes Fuel Bitcoin Rally

The BTC/USD rallied after the relatively disappointing employment data from the United States yesterday. In its report, ADP said that the American economy lost 123,000 jobs in December. This was the first time to do so since April last year. Economists polled by Reuters were expecting the private employers to add about 88,000 jobs.

These numbers sent a sign that the American economy is indeed slowing and that more is needed to support it. Data came on the same day that Democrats took control of the Senate after their two victories in Georgia.

As such, cryptocurrency traders believe that the government will launch a more aggressive stimulus package in the near term. Already, congressional Democrats have passed a new package with a $2,000 check. Before the recently-passed $900 billion stimulus package, they had supported a $2 trillion spending with billions going to states and local governments. Also, they will probably focus on infrastructure spending.

Subsequently, this will lead to a relatively weaker US dollar. Indeed, the US Dollar Index is hovering at its lowest level since 2018. A weak US dollar tends to be positive for assets like Bitcoin and gold.

Bitcoin price is also rallying due to the large institutional demand. In recent months, companies like Mass Mutual, Square, MicroStrategy, and PayPal have invested millions of dollars in the currency. These holdings are now worth billions. Also, inflows in Bitcoin-tracked funds like Grayscale have continued to rise.

BTC/USD Technical Outlook

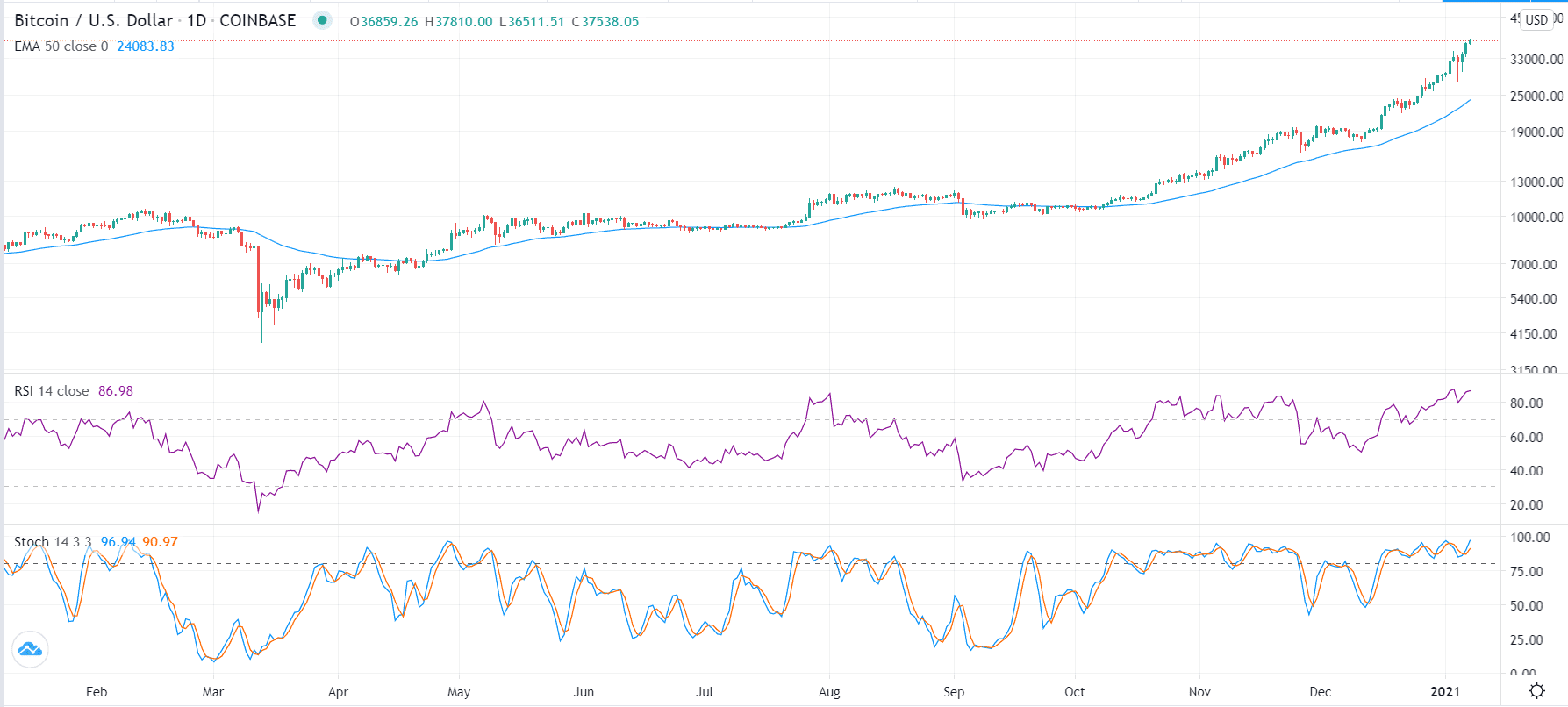

The daily chart shows that the Bitcoin price has been on a robust rally recently. It has moved above all moving averages, which is a sign that bulls are still in control. Similarly, oscillators like the Relative Strength Index (RSI) and Stochastic have all moved to the overbought zone.

Therefore, the price will likely continue soaring because of the current momentum. In the near term, the next resistance to watch is $40,000, which will open the possibility of it rising to $50,000.