Bearish Case

Short BTC/USD at the present level.

Put a take profit at the psychological level at $30,000.

Add a stop loss at $33,000.

Bullish case

Buy the BTC/USD pair.

Put a take profit at the YTD high of $34,829.

Add a stop loss at $30,000.

Bitcoin price is under pressure, two days after it soared to its all-time high of $34,829. The cryptocurrency is trading at $31,500, which is ~10% below the all-time high that was reached on Sunday.

Profit-Taking After a Strong Rally

The current weakness of Bitcoin price is mostly because of profit-taking after the currency rallied by more than 700% from its lowest level in March. In total, it gained by more than 200% in 2020, becoming one of the best-performing assets.

This rally was driven by several factors. First, Bitcoin halving, where the award of mining Bitcoin is slashed into half, happened between May and June. This led to more scarcity in the market, which drove up the price of the currency.

Second, the Federal Reserve policy response to the coronavirus pandemic pushed more investors to risky assets. The bank slashed interest rates and announced its biggest ever quantitative easing program. This pushed its total balance sheet to more than $7.7 trillion, a record.

Finally, Bitcoin rose due to strong institutional demand. For example, the total assets by the Greyscale Bitcoin Trust soared from less than $2 billion in January 2020 to more than $6.3 billion. This trend was driven by moneyed institutional investors.

Meanwhile, more companies like Paypal, Square and MicroStrategy shifted some of their treasuries to Bitcoin. This year, more companies will likely follow suit.

Therefore, the current weakness in Bitcoin is probably due to retail traders who are exiting after making substantial gains last year.

Bitcoin Price Technical Outlook

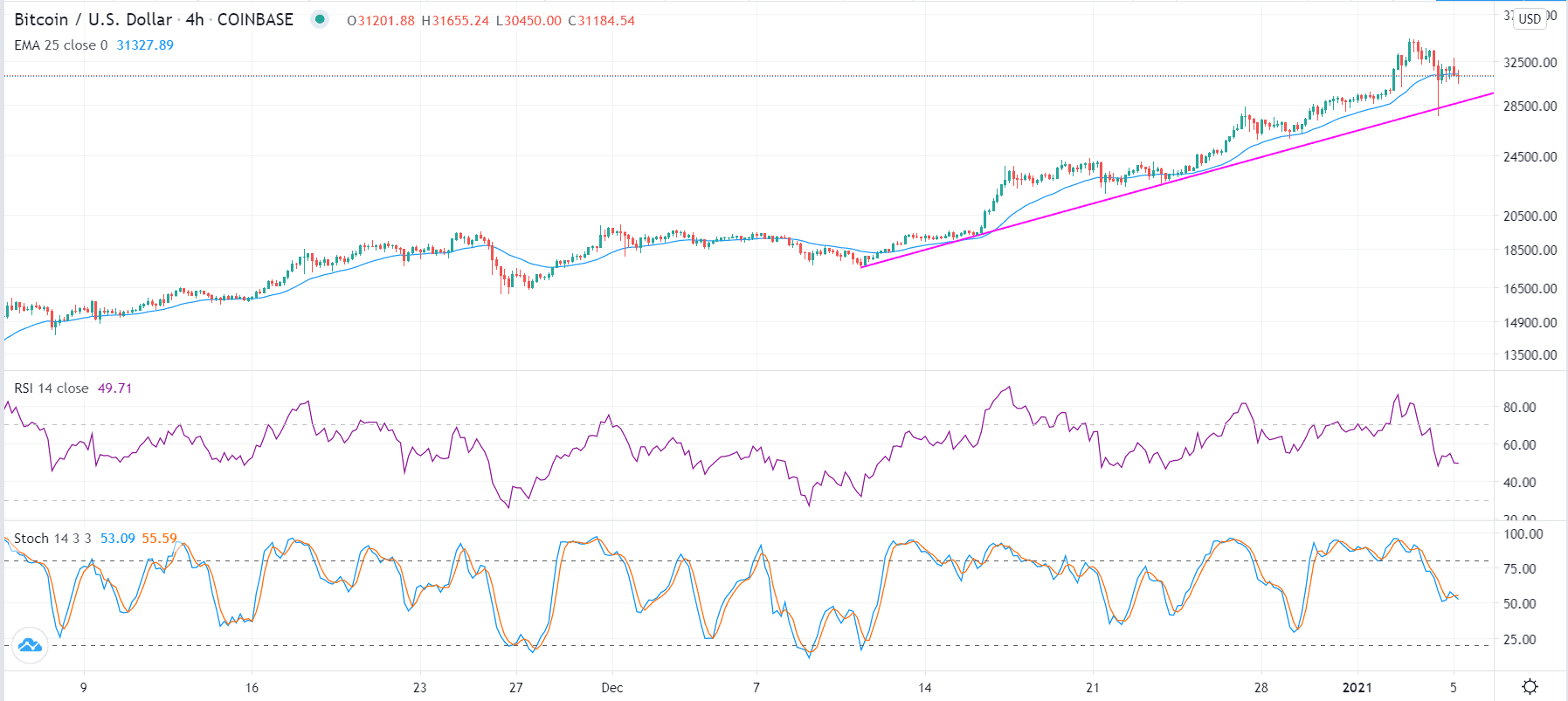

The price of Bitcoin dropped to an intraday low of $27,756 yesterday after rallying by 20% during the weekend. On the four-hour chart, the price has moved slightly below the 25-day exponential moving average. The Relative Strength Index (RSI) has also moved from the overbought level of 84 to the current level of 48.

Similarly, the fast and slow lines of the Stochastic Oscillator have also dropped from 96 to below 60. Therefore, while the overall trend is bullish, the price will likely continue to drop in the near term. If it does, the key support will be the psychological level of $30,000.