Last Wednesday’s signals were not triggered, as there was no bullish price action when the support level identified at $34,512 was first reached.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Tuesday.

Long Trade Ideas

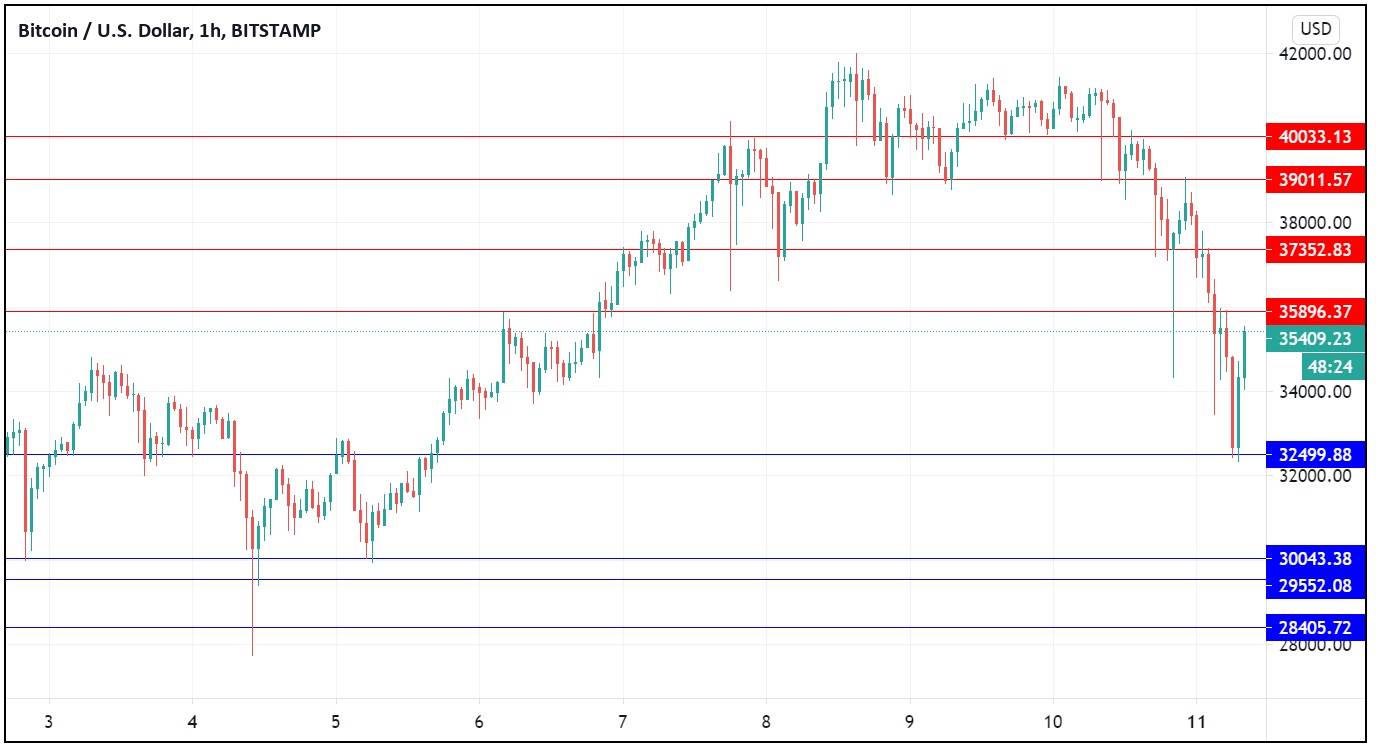

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $32,500 or $30,043.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $35,896, $37,353, $39,012, or $40,033.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that although volatility remained relatively very high, there were no clear signs of climax and exhaustion, so as we were trading into the blue sky of all-time highs, there was no reason not to take a bullish bias here.

I also said that bulls should beware of a climax if the price quickly reached the major round number at $40,000.

This was an excellent call, as the price continued to rise by another $7,000 or so before appearing to climax on very high volatility a little way above the all-time high near $42,000.

Volatility is very high, and the sharp drop we have seen over just the past couple of days with a near-25% fall in value suggests that we have just seen the highest price that Bitcoin will make for a while.

Despite the sharp fall, we are seeing Bitcoin recover over the past few hours after finding support at the key round number of $32,500.

The high volatility and seeming blow-off climax makes Bitcoin somewhat dangerous to trade right now.

The key thing to watch for today is whether the nearest new resistance level at $35,896 will hold – if it does, that will be further evidence that we have a bearish climax.

It might be wise to step aside from trading Bitcoin today, as I think we are unlikely to see the price reach a new high for several weeks, months, or even years.

Bitcoin is likely to consolidate or fall to new lows, but arguably can be bought if a tight stop can be placed technically from either $32,500 or $30,000 – or very close to these levels.

There is nothing of high importance scheduled today concerning the USD.