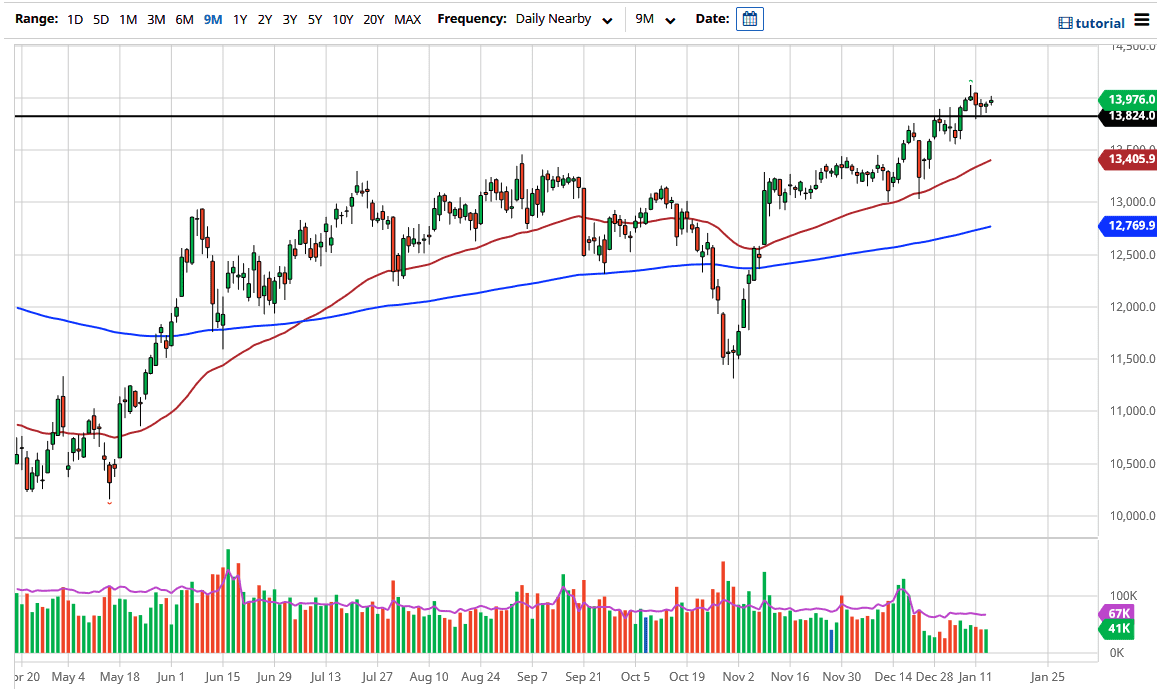

The German index went back and forth during the trading session on Thursday as we hover above what was once significant resistance in the form of the 13,825 level. That is an area that I think continues to be interesting, at least from a short-term support standpoint. We have formed a couple of support of candle’s earlier this week, so it does suggest that we have more bullish pressure underneath to eventually send this market higher. After all, we are looking at a scenario where the world is going into reflation, and that should continue to drive up demand for stocks and of course hard assets.

Germany is a major exporter of large industrial goods, so it does make sense that a lot of people would be looking into the idea of buying German stocks. The reflation trade is going on around the world, and therefore various stocks will continue to see plenty of interest. I believe that Germany will be one of the first major European indices to truly take off in the face of potential currency devaluation as well, because it is considered to be the “safest economy” on the continent. This does not necessarily mean that the economy itself is going to take off, rather that we are simply going to see people looking to protect wealth by owning assets.

To the downside, not only do I see the 13,825 level as support, but I also see the 13,500 level as support, as well as the 50 day EMA which sits at the 13,400 level. Ultimately, this is a market that I think is almost impossible to short anytime soon, especially if we continue to see the Euro drift a little bit lower. To the upside, I believe that the DAX will go looking towards the 14,500 level initially, before reaching towards the 15,000 level. I would not be surprised at all to see this market go much higher than that, but it looks like we are going to be somewhat content to simply grind away. There has been a bit of an issue with rising interest rates in the United States for the short term, which some people will simply put money into bonds in that scenario. Longer-term though, I do not think that is going to be much of an issue, and eventually people will get back to pushing equities higher.