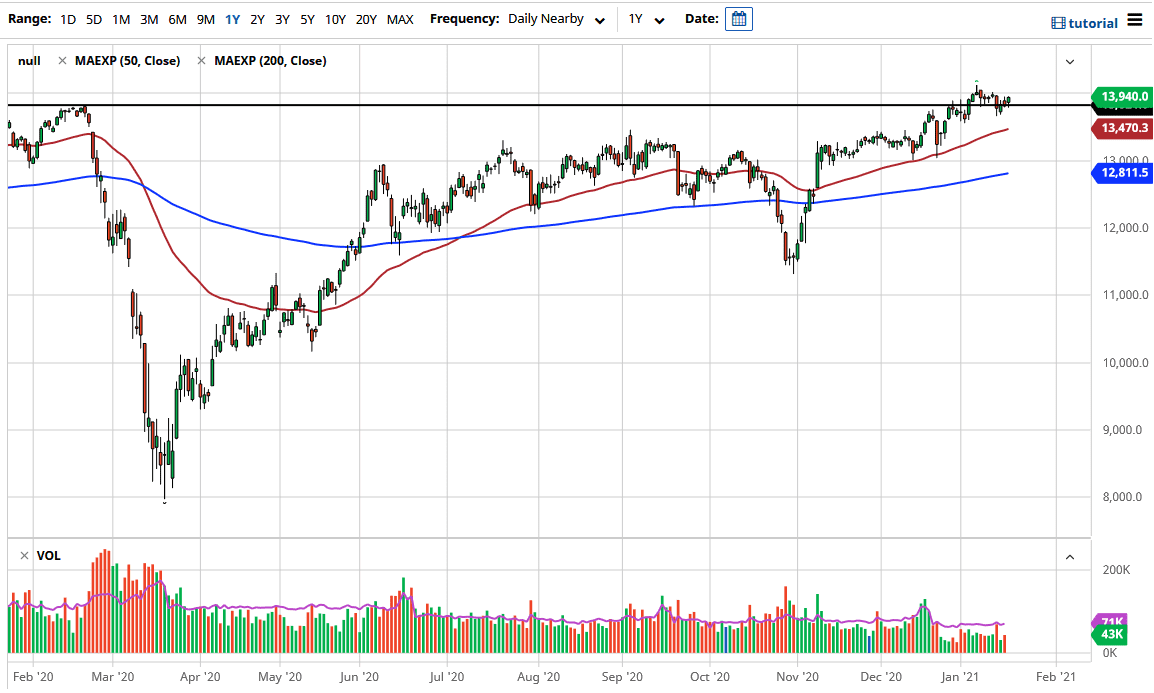

The German index initially pulled back a bit during the trading session on Wednesday but then turned around to form a slightly bullish candlestick. The 13,800 level previously had been important, so now it looks as if it is going to continue to be so to the upside as well. If we can break above the 14,000 level, then it is likely that we could go towards the 15,000 level as it is such a large, round, psychologically significant target. Furthermore, this does jive well with the whole idea of the “reflation trade” that a lot of traders are trying to get into worldwide. Remember, the DAX is heavily laden with German exporters, so the idea is that large industrial exporters will do well in that type of scenario.

Another thing to keep in mind is that the DAX is considered to be the “safest” index to invest in when it comes to the European Union. There could be a little bit of a “safety trade” into the DAX due to concerns about the slow speed in which the coronavirus vaccine is being distributed in the European Union. After all, most traders would not want to expand out to the Ibex 35 or the MIB in Italy when they can just buy a company like Siemens. In other words, they need to see a reason to step out onto the risk curve, which eventually they will but right now people are going to be very cautious.

Furthermore, I believe that the technical outlook for the DAX is very strong due to the fact that we had recently broken to a fresh, new high and one of the main reasons we pull back is that we reached the 14,000 level which had a certain amount of influence. I think that given enough time we are probably going to continue to see noisy behavior but ultimately the upward will be the slope in which the market follows. If we did break down significantly, I believe that the 50 day EMA is where a lot of people would make their stand as far as the uptrend is concerned. I have no scenario in which I would be a seller, unless of course the Euro suddenly spiked a lot higher as it would make German exports more expensive.