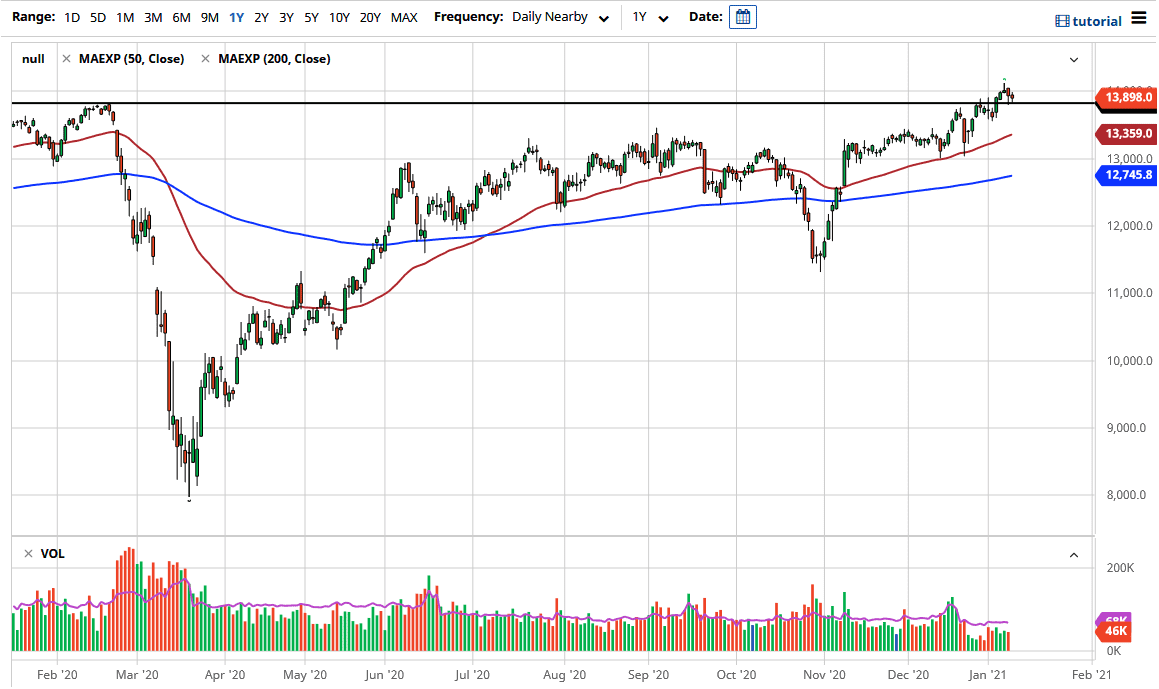

The DAX Index initially fell during trading on Tuesday as we crashed into the 13,825 level. This is an area that has been important in the past, as it was significant resistance and now should offer support. Luckily, the market has done exactly that and bounced from that area. This is a market that will find a lot of buyers on the dips, due to the fact that there has been a lot of stimulus thrown around out there, which favors exports in general. The DAX is laden with large exporters, so it follows that it will do quite well in this environment. After all, the “reflation trade” favors a lot of industrial components such as the blue-chip stocks that we see in the DAX.

The US dollar falling also helps the idea of money leaving the United States and looking for places to find more of a return. The first stop will be Germany, although given enough time, we will see money leave there as well, looking for even more risk. At this point, Germany has a big part to play in the global growth situation, and then we should see most of these big companies do quite well.

The euro has shown itself to be somewhat strong, and that does work against the value of the DAX if it gets overdone. However, we are nowhere near there right now, especially when you take the trade-weighted euro, which is essentially the same thing as the US Dollar Index, just measured against Europe’s major trading partners based in euros. It is still relatively low, meaning that the European Central Bank will probably stay out of the way, and that means that the DAX could very well continue to go higher despite the fact that we may have an increasing euro in general.

To the downside, the 50-day EMA sits at the 13,365 level, which I believe is the beginning of the “floor of the market” that extends down to the 13,000 handle. As for an upside target, we are probably trying to get to the 15,000 handle, but it does not necessarily mean we will get there overnight. This looks more like a market that will see a slow and gentle grind higher.